Kodak 2000 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2000 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.25

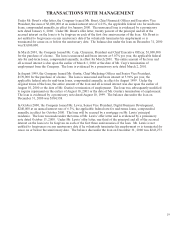

Employment Contracts and Arrangements

George M. C. Fisher - The Company employed Mr. Fisher under an employment contract that terminated on

December 31, 2000. In addition to information found elsewhere in this Proxy Statement, the contract, as

amended, provided credit for years of service under the Company’s benefit plans, including 22 years of

deemed service and five additional years of age for the retirement plan. The pension benefit paid to Mr.

Fisher was reduced by the pension paid to him by his prior employer.

The contract also provided Mr. Fisher the following benefits after his retirement from the Company:

• use of office facilities and secretarial assistance;

• use of the Company’s aircraft for certain business travel;

• limited use for personal purposes of the Company’s aircraft during the two-year period immediately

following his retirement;

• life insurance coverage of $3 million;

• retiree coverage under the Company’s health and dental plans.

Following his retirement, Mr. Fisher retained both his stock option and restricted stock awards.

Daniel A. Carp - Effective December 10, 1999, the Company entered into a letter agreement with Mr. Carp

providing for his employment as President and Chief Executive Officer. The letter agreement provides for a

base salary of $1,000,000, subject to annual adjustment, and a target annual bonus of 105% of his base salary.

Mr. Carp’s compensation will be reviewed annually by the Executive Compensation and Development

Committee. In light of Mr. Carp’s promotion to Chairman in December 2000, the Executive Compensation

and Development Committee approved an increase to Mr. Carp’s target annual bonus to 145% of his base

salary.

If the Company terminates Mr. Carp’s employment without cause, Mr. Carp will be permitted to retain his

stock options and restricted stock. He will also receive severance pay equal to three times his base salary plus

target annual bonus and prorated awards under the Company’s bonus plans. The letter agreement also provides

that for pension purposes, Mr. Carp will be treated as if he were age 55, if he is less than age 55 at the time of

his termination, or age 60, if he is age 55 or older but less than age 60, at the time of his termination of

employment.

In the event of Mr. Carp’s disability, he will receive the same severance pay as he would receive upon

termination without cause; except it will be reduced by the present value of any Company-provided disability

benefits he receives. The letter agreement also states that upon Mr. Carp’s disability, he will be permitted to

retain all of his stock options.

Eric L. Steenburgh - In April 1998, the Company hired Mr. Steenburgh under an offer letter dated March 12,

1998. If, during the first five years of Mr. Steenburgh’s employment, the Company terminates his employment

without cause, or if Mr. Steenburgh voluntarily terminates employment for good reason, he will receive

severance pay equal to one times his base salary plus target annual bonus. After he has been employed for

five years, Mr. Steenburgh will be credited with 20 extra years of service for pension purposes.

Robert H. Brust - The Company employed Mr. Brust under an offer letter dated December 20, 1999. In

addition to the information provided elsewhere in this Proxy Statement, the offer letter provides Mr. Brust a

special severance benefit. If during the first five years of Mr. Brust’s employment, the Company terminates

his employment without cause, he will receive severance pay equal to one times his base salary plus target

annual bonus. After completing five years of service with the Company, Mr. Brust will be allowed to keep his

stock options upon his termination of employment for other than cause.