Kodak 2000 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2000 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

22

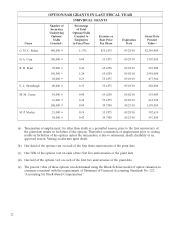

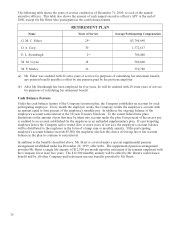

OPTION/SAR GRANTS IN LAST FISCAL YEAR

INDIVIDUAL GRANTS

Number of Percentage

Securities of Total

Underlying Options/SARs

Options/ Granted to Exercise or Grant Date

SARs Employees Base Price Expiration Present

Name Granted(a) in Fiscal Year Per Share Date Value(e)

G. M. C. Fisher 140,000 (b) 1.17% $55.1875 03/29/10 $2,389,800

D. A. Carp 100,000 (b) 0.84 55.1875 03/29/10 1,707,000

R. H. Brust 50,000 (b) 0.42 65.6250 01/02/10 967,000

150,000 (c) 1.26 65.6250 01/02/10 2,901,000

28,000 (b) 0.23 55.1875 03/29/10 477,960

E. L. Steenburgh 40,000 (b) 0.33 55.1875 03/29/10 682,800

M. M. Coyne 10,000 (b) 0.08 65.6250 01/02/10 193,400

36,000 (b) 0.30 55.1875 03/29/10 614,520

100,000 (d) 0.84 39.7500 10/23/10 1,195,000

M. P. Morley 23,000 (b) 0.19 55.1875 03/29/10 392,610

50,000 (d) 0.42 39.7500 10/23/10 597,500

(a) Termination of employment, for other than death or a permitted reason, prior to the first anniversary of

the grant date results in forfeiture of the options. Thereafter, termination of employment prior to vesting

results in forfeiture of the options unless the termination is due to retirement, death, disability or an

approved reason. Vesting accelerates upon death.

(b) One third of the options vest on each of the first three anniversaries of the grant date.

(c) One fifth of the options vest on each of the first five anniversaries of the grant date.

(d) One half of the options vest on each of the first two anniversaries of the grant date.

(e) The present value of these options was determined using the Black-Scholes model of option valuation in

a manner consistent with the requirements of Statement of Financial Accounting Standards No. 123,

“Accounting for Stock-Based Compensation”.