Kodak 2000 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2000 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

its e-commerce strategies, and to complete information systems

upgrades; the successful completion of various portfolio actions;

the ability of the Company to reduce inventories, improve re c e i v -

ables perf o rmance, and reduce capital expenditures; the inhere n t

u n p redictability of currency fluctuations and raw material costs;

competitive actions, including pricing; the ability to reduce spend-

ing and realize operating efficiencies, including a significant

reduction in SKU’s; the ability to achieve planned impro v e m e n t s

in Kodak Professional; the nature and pace of technology substi-

tution; the ability of the Company to develop its business in

e m e rging markets like China and India; general economic and

business conditions, including the timing of a business upturn ;

and other factors disclosed previously and from time to time in the

C o m p a n y ’s filings with the Securities and Exchange Commission.

Any forw a rd-looking statements in this re p o rt should be

evaluated in light of these important risk factors.

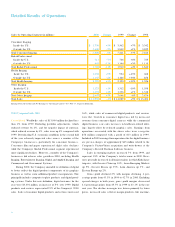

Market Price Data

2 0 0 0 1 9 9 9

Price per share : H i g h L o w H i g h L o w

1st Qtr. $6 7 . 5 0 $ 5 3 . 3 1 $ 8 0 . 3 8 $ 6 2 . 3 1

2nd Qtr. 6 3 . 6 3 5 3 . 1 9 7 9 . 8 1 6 0 . 8 1

3 rd Qtr. 6 5 . 6 9 3 9 . 7 5 7 8 . 2 5 6 8 . 2 5

4th Qtr. 4 8 . 5 0 3 5 . 3 1 7 7 . 5 0 5 6 . 6 3

S u m m a ry of Operating Data

A summary of operating data for 2000 and for the four years prior

is shown on page 64.

Quantitative and Qualitative Disclosures about Market Risk

The Company, as a result of its global operating and financing

activities, is exposed to changes in foreign currency exchange

rates, commodity prices, and interest rates, which may adversely

a f fect its results of operations and financial position. In seeking

to minimize the risks and/or costs associated with such activi-

ties, the Company may enter into derivative contracts. See also

Note 9, Financial Instru m e n t s .

On January 1, 2000, the Company adopted Financial

Accounting Standards Board (FAS B) Statement of Financial

Accounting Standards (SFAS) No. 133, “Accounting for Deriva-

tive Instruments and Hedging Activities.” This Statement re q u i re s

that an entity recognize all derivatives as either assets or liabilities

and measure those instruments at fair value. If certain conditions

a re met, a derivative may be designated as a hedge. The account-

ing for changes in the fair value of a derivative depends on the

intended use of the derivative and the resulting designation.

The transition adjustment was a pre-tax loss of $1 million

($1 million after tax) re c o rded in other income (charges) for

marking foreign exchange forw a rd contracts to fair value, and a

p re-tax gain of $3 million ($2 million after tax) re c o rded in other

c o m p rehensive income for marking silver forw a rd contracts to fair

value. These items were not displayed in s eparate captions as

cumulative effects of a change in accounting principle, due to

their immateriality. The fair value of the contracts is re p o rted in

other current assets or in current payables.

The Company has entered into foreign currency forw a rd

contracts that are designated as cash flow hedges of exchange

rate risk related to forecasted foreign currency denominated

i n t e rcompany sales. At December 31, 2000, the Company had

cash flow hedges for the Euro, the Canadian dollar, and the

Australian dollar, with maturity dates ranging from January 2001

to December 2001.

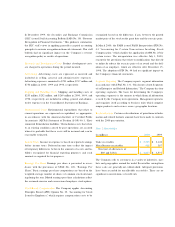

At December 31, 2000, the fair value of all open foreign cur-

rency forw a rd contracts was a pre-tax unrealized loss of $44 mil-

lion. Of this pre-tax loss, $42 million has been deferred as a part

of other compre hensive income while $2 million has been

c h a rge d to othe r income (c harge s ) on the C o mp any’s

Consolidated Statement of Earnings. Additionally, realized gains

of approximately $2 million (pre-tax), related to closed foreign cur-

rency contracts, have been deferred in other compre h e n s i v e

income. If all amounts deferred to other comprehensive income

w e re to be realized, approximately $39 million would be re c l a s s i -

fied into cost of goods sold over the next twelve months, based

on sales to third parties. During the year, a realized gain of $9 mil-

lion (pre-tax) was reclassified from other comprehensive income

to cost of goods s old. Hedge ineffectiveness was insignificant.

The Company does not apply hedge accounting to the for-

eign currency forw a rd contracts used to offset curre n c y - re l a t e d

changes in the fair value of foreign currency denominated assets

and liabilities. These contracts are marked to market thro u g h

e a rnings at the s ame time that the exposed assets and liabilities

a re re m e a s u red through earnings (both in other income). The

majority of the contracts held by the Company are denominated

in Euros, Australian dollars, Chinese renminbi, Canadian dollars,

and British pounds.

A sensitivity analysis indicates tha t if foreign curre n c y

exchange rates at December 31, 2000 and 1999 increased 10% ,

the Company would incur losses of $88 million and $87 million

on foreign currency forw a rd contracts outstanding at Decem-

ber 31, 2000 and 1999, re s p e c t i v e l y. Such losses would be sub-