Kodak 2000 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2000 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.1 9 9 8 In June 1998, the Company sold part of its investment in

G retag Imaging Group, a Swiss manufacturer of film pro c e s s i n g

equipment, in connection with Gre t a g ’s initial public offering. The

p roceeds from the sale were $72 million and res ulted in a pre - t a x

gain of $66 million in other income (charg e s ) .

On September 1, 1998, the Company sold all of its share s

of Fox Photo, Inc. to Wolf Camera for an amount appro x i m a t i n g

the current value of Fox Photo’s net assets.

On October 1, 1998, Elan C orporation, plc purchased

f rom Kodak all the assets and liabilities of Kodak’s subsidiary

NanoSystems L.L.C., a drug delivery company, for appro x i m a t e l y

$150 million in a combination of $137 million cas h and warr a n t s

to purchase ord i n a ry shares in Elan. The Company re c o rded a

p re-tax gain of $87 million in other income (charges) on the sale

in the fourth quarter of 1998.

In the fourth quarter of 1998, financial difficulties on the part

of Danka affected its ability to fulfill the original terms of cert a i n

of its agreements with the Company which were established in

connection with the sale of the Office Imaging business in 1996.

As a result, in December 1998, the Company’s supply agre e m e n t

and certain other agreements with Danka were terminated and

interim arrangements for the supply by the Company to Danka of

copier equipment, parts and supplies were established on a

month-to-month basis. As a result of significant volume re d u c-

tions by Danka, the Company was re q u i red to take action in the

f o u rth quarter of 1998 that resulted in charges for employee

severance (800 personnel) and write-downs of working capital

and equipment. Such pre-tax charges amounted to $132 mil-

lion and were re c o rded to cost of goods sold ($68 million) and

SG&A expenses ($64 million). All actions with respect to this

c h a rge, including employee terminations, were completed by the

Company in 1998.

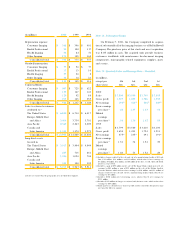

Note 17: Segment Inform a t i o n

The Consumer Imaging segment derives revenues from photo-

graphic film, paper, chemicals, cameras, photoprocessing equip-

ment, digitization services, and photoprocessing services sold

to consumers. The Kodak Professional segment derives re v e n u e s

f rom photographic film, paper, chemicals, and digital cameras

sold to professional customers and graphics film products sold

to the KPG joint venture. The Health Imaging segment derives

revenues from medical film and processing equipment sold to

h e a l t h c a re organizations. The Other Imaging segment derives re v -

enues from motion picture film sold to movie production and dis-

tribution companies, and microfilm equipment and media,

printers, scanners, other business equipment, document imaging

s o f t w a re, and consumer digital cameras and media sold to com-

m e rcial and government customers.

Trans actions between segments, which are immaterial,

a re made on a basis intended to reflect the market value of

the products, recognizing prevailing market prices and distribu-

tor discounts . Diff e rences between the re p o rtable segments’

operating results and net assets, and the Company’s consoli-

dated financial statements relate primarily to items held at the

corporate level, and to other items excluded from segment oper-

ating measure m e n t s .