Kodak 2000 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2000 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

In December 1999, the Securities and Exchange Commission

(SEC) issued Staff Accounting Bulletin (SAB) No. 101 “Revenue

Recognition in Financial S tatements.” This guidance summarizes

the SEC staff’s views in applying generally accepted accounting

principles to revenue recognition in financial statements. This staff

bulletin had no significant impact on the C ompany’s re v e n u e

recognition policy or results of operations.

R e s e a rch and Development Costs P roduct development costs

a re charged to operations during the period incurre d .

A d v e rt i s i n g A d v e rtising costs are expensed as incurred and

includ ed in s elling, general and administrative e xpe ns es.

A d v e rtising expenses amounted to $701 million, $717 million and

$756 million in 2000, 1999 and 1998, re s p e c t i v e l y.

Shipping and Handling Costs Shipping and handling costs of

$253 million, $252 million, and $269 million in 2000, 1999, and

1998, re s p e c t i v e l y, are included in selling, general and adminis-

trative expens es on the Consolidated Statement of Earn i n g s .

E n v i ronmental Costs E n v i ronmental expenditures that relate to

c u rrent operations are expensed or capitalized, as appropriate,

in accordance with the American Institute of C ertified Public

Accountants (AICPA) Statement of Position (SOP) 96-1, “Envi-

ronmental Remediation Liabilities.” Remediation costs that re l a t e

to an existing condition caused by past operations are accru e d

when it is probable that these costs will be incurred and can be

reasonably estimated.

Income Ta x e s Income tax expense is based on re p o rted earn i n g s

b e f o re income taxes. Deferred income taxes reflect the impact

of temporary diff e rences between the amounts of assets and lia-

bilities recognized for financial re p o rting purposes and such

amounts recognized for tax purposes.

E a rnings Per Share E a rnings per share is presented in accor-

dance with the provisions of S FAS No. 128, “Earnings Per

S h a re.” Basic earn i n g s - p e r- s h a re computations are based on the

weighted-average number of shares of common stock outstand-

ing during the year. Diluted earn i n g s - p e r- s h a re calculations re f l e c t

the assumed exercise and conversion of employee stock options.

Stock-Based Compensation The C ompany applies Accounting

Principles Board (APB) Opinion No. 25, “Accounting for Stock

Issued to Employees,” which re q u i res compensation costs to be

recognized based on the diff e rence, if any, between the quoted

market price of the stock on the grant date and the exercise price.

In March 2000, the FASB issued FASB Interpretation (FIN) No.

44 “Ac counting for Ce rtain Trans actions Involving S tock

Compensation,” which clarifies the application of APB No. 25 for

c e rtain issues. The interpretation was effective July 1, 2000,

except for the provisions that relate to modifications that dire c t l y

or indirectly reduce the exercise price of an award and the defi-

nition of an employee, which are effective after December 15,

1998. The adoption of FIN No. 44 had no significant impact on

the C ompany’s financial statements.

Segment Report i n g The Company re p o rts segment inform a t i o n

in accordance with SFAS No. 131, “Disclosures about Segments

of an Enterprise and Related Information.” The Company has four

operating segments. The basis for determining the Company’s

operating segments is the manner in which financial inform a t i o n

is used by the Company in its operations. Management operates

and organizes itself according to business units which comprise

unique products and services across geographic locations.

Reclassifications C e rtain reclassifications of prior financial infor-

mation and related footnote amounts have been made to conform

with the 2000 pre s e n t a t i o n .

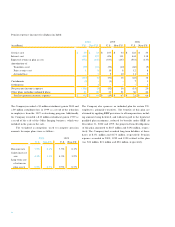

Note 2: Receivables

(in millions) 2 0 0 0 1 9 9 9

Trade re c e i v a b l e s $2 , 2 4 5 $2 , 1 4 0

Miscellaneous re c e i v a b l e s 4 0 8 3 9 7

Total (net of allowances of

$89 and $136) $2 , 6 5 3 $2 , 5 3 7

The Company sells to customers in a variety of industries, mar-

kets and geographies around the world. Receivables arising fro m

these sales are generally not collateralized. Adequate pro v i s i o n s

have been re c o rded for uncollectible receivables. There are no

significant concentrations of credit risk.