Kodak 2000 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2000 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

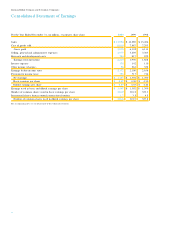

For the Year Ended December 31, (in millions) 2 0 0 0 1 9 9 9 1 9 9 8

Cash flows from operating activities:

Net earn i n g s $1 , 4 0 7 $1 , 3 9 2 $ 1 , 3 9 0

Adjustments to reconcile to net cash provided by operating activities:

D e p reciation and amort i z a t i o n 8 8 9 9 1 8 8 5 3

Gains on sales of businesses/assets ( 1 1 7 ) ( 1 6 2 ) ( 1 6 6 )

R e s t ructuring costs, asset impairments and other charg e s –4 5 3 4 2

P rovision for deferred income taxes 2 3 5 2 4 7 2 0 2

I n c rease in re c e i v a b l e s ( 2 4 7 ) ( 1 2 1 ) ( 1 )

I n c rease in inventories ( 2 8 2 ) ( 2 0 1 ) ( 4 3 )

D e c rease in liabilities excluding borro w i n g s ( 7 5 5 ) ( 4 7 8 ) ( 5 1 6 )

Other items, net ( 1 4 8 ) ( 1 1 5 ) ( 2 7 8 )

Total adjustments ( 4 2 5 ) 5 4 1 9 3

Net cash provided by operating activities 9 8 2 1 , 9 3 3 1 , 4 8 3

Cash flows from investing activities:

Additions to pro p e rt i e s ( 9 4 5 ) ( 1 , 1 2 7 ) ( 1 , 1 0 8 )

P roceeds from sales of businesses/assets 2 7 6 4 6 8 2 9 7

Cash flows related to sales of businesses 1( 4 6 ) ( 5 9 )

Acquisitions, net of cash acquire d ( 1 3 0 ) ( 3 ) ( 9 4 9 )

Marketable securities — sales 8 4 1 2 7 1 6 2

Marketable securities — purc h a s e s ( 6 9 ) ( 1 0 4 ) ( 1 8 2 )

Net cash used in investing activities ( 7 8 3 ) ( 6 8 5 ) ( 1 , 8 3 9 )

Cash flows from financing activities:

Net increase (decrease) in borrowings with original maturities of 90 days or less 9 3 9 ( 1 3 6 ) 8 9 4

P roceeds from other borro w i n g s 1 , 3 1 0 1 , 3 4 3 1 , 1 3 3

Repayment of other borro w i n g s ( 9 3 6 ) ( 1 , 1 1 8 ) ( 1 , 2 5 1 )

Dividends to s hare h o l d e r s ( 5 4 5 ) ( 5 6 3 ) ( 5 6 9 )

E x e rcise of employee stock options 4 3 4 4 1 2 8

Stock re p u rchase pro g r a m s ( 1 , 1 2 5 ) ( 8 9 7 ) ( 2 5 8 )

Net cash (used in) provided by financing activities ( 3 1 4 ) ( 1 , 3 2 7 ) 7 7

E ffect of exchange rate changes on cash ( 1 2 ) ( 5 ) 8

Net decrease in cash and cash equivalents ( 1 2 7 ) ( 8 4 ) ( 2 7 1 )

Cash and cash equivalents, beginning of year 3 7 3 4 5 7 7 2 8

Cash and cash equivalents, end of year $2 4 6 $3 7 3 $ 4 5 7

Supplemental Cash Flow Inform a t i o n

Cash paid for interest and income taxes was:

I n t e rest, net of portion capitalized of $40, $36 and $41 $1 6 6 $1 2 0 $ 9 0

Income taxes 4 8 6 4 4 5 4 9 8

The following transactions are not reflected in the Consolidated Statement of Cash Flows:

Contribution of assets to Kodak Polychrome Graphics joint venture $ – $1 3 $ –

Minimum pension liability adjustment ( 1 ) ( 1 4 ) 4

Liabilities assumed in acquisitions 3 1 –4 7 3

The accompanying notes are an integral part of these financial statements.

Eastman Kodak Company and Subsidiary Companies

Consolidated Statement of Cash Flows