Kodak 2000 Annual Report Download - page 36

Download and view the complete annual report

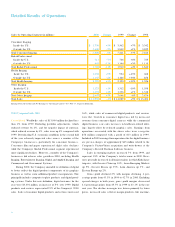

Please find page 36 of the 2000 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.1999 Compared with 1998

C o n s o l i d a t e d Worldwide sales for 1999 increased 5% over the

prior year. The impact of portfolio actions on the year- t o - y e a r

comparison was essentially neutral. Currency changes against

the dollar negatively affected sales by $12 million. Sales gro w t h

in 1999 was achieved across numerous businesses, including

Health Imaging film (analog film as well as laser imaging pro d u c t s

of the acquired Imation medical imaging business), consumer and

p rofessional digital cameras, Consumer Imaging color paper and

film (especially Advantix film and one-time-use cameras), C D

media, and inkjet media.

Sales in emerging markets increased 6% , and accounted

for approximately 16% of the Company’s 1999 worldwide sales.

The emerging markets portfolio showed growth across a wide

geographical range, with China up 30%, Korea up 36% and India

up 19% . Strong growth in Mexico of 16% was offset by a 16%

decline in Brazil, resulting in a 2% decline in the Latin American

Region. Sales in Russia were weak, reflecting a 33% sales

decline from 1998.

Overall gros s profit margins decreased 2.3 perc e n t a g e

points from 45.6% in 1998 to 43.3% in 1999. Excluding special

c h a rges in both years, gross profit margins decreased .4 per-

centage points from 46.1% in 1998 to 45.7% in 1999. Gro s s

p rofit margins were pre s s u red by lower prices, increased levels

of goodwill amortization, startup costs in the China manufactur-

ing project, and the acquired Imation medical imaging business,

which had gross profit rates lower than the Company average.

These pre s s u res were offset, almost entire l y, by gains in manu-

facturing pro d u c t i v i t y, improvements in digital businesses, and the

beneficial effects of portfolio actions taken, including the divesti-

t u re of Office Imaging and a significant portion of Consumer

I m a g i n g ’s retail business.

SG&A expenses for the Company were essentially level,

but decreased from 24.6% of sales in 1998 to 23.4% in 1999.

Excluding re s t ructuring charges, SG&A expenses decreased 2%

f rom the prior year and declined as a percentage of sales fro m

24.1% in 1998 to 22.5% in 1999. SG&A excluding advert i s i n g

expenses also decreased, from 18.5% to 17.4% of sales. The

d e c rease in rates, excluding re s t ructuring charges, is due to

higher sales and cost reduction activities as well as reductions in

a d v e rtising expense.

Excluding the Imation charge in 1998, R&D decreased 7%,

f rom 6.6% of sales in 1998 to 5.8% in 1999, as a result of a num-

ber of factors, including improvement in the R&D cost stru c t u re ,

a more tightly focused portfolio, and more joint development, with

m o re work shared with part n e r s .

E a rnings from operations increased 5% to $1,990 million.

Excluding special charges in both years, earnings from opera-

tions increased $389 million or 19% , as the benefits of higher unit

sales volumes across many of the Company’s key products, man-

ufacturing pro d u c t i v i t y, and cost reductions more than off s e t

lower effective selling prices and the unfavorable effects of cur-

rency rate changes.

I n t e rest expense increased 29% in 1999 to $142 million, pri-

marily due to higher average borrowings. Other income (charg e s )

d e c reased $67 million from the prior year. Excluding special

c h a rges and credits from 1999 and 1998, other income (charg e s )

d e c reased $70 million, resulting primarily from reduced invest-

ment income, lower gains on asset sales and R&D investments in

the NexPress joint venture. The effective tax rates were 34% in

both 1999 and 1998.

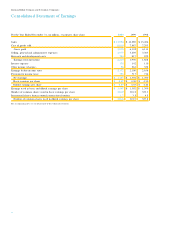

Consumer Imaging Consumer Imaging segment sales incre a s e d

3% in 1999. Excluding the impact of the divestiture of the Fox

Photo operating unit in September 1998, sales increased 6% ,

as higher volumes more than offset lower effective selling prices

and the negative effects of exchange. Sales inside the U.S.

i n c reas ed 7% , as higher volumes were partly offset by lower

e ffective selling prices and the impact of portfolio changes. Sales

outside the U.S. increased 1%, as higher volumes more than

o ffset lower effective selling prices and the negative effects of

e x c h a n g e .

Worldwide film sales increased 4% over 1998, as volume

i n c reases of 10% more than offset lower effective selling prices.

Sales inside the U.S. increased 2% , as higher unit volumes more

than offset lower effective selling prices. Sales outside the U.S.

i n c reased 5%, as higher volumes more than offset lower eff e c-

tive selling prices and the unfavorable effects of currency rate

c h a n g e s .

Worldwide color paper sales increased 6% over 1998, as

volume increases of 9% more than offset lower effective selling

prices. Sales inside the U.S. were particularly strong, incre a s i n g

12% , due to higher unit volumes and slightly higher effective

selling prices. Sales outs ide the U.S. increased 2%, as higher

volumes more than offset lower effective selling prices and the

unfavorable effects of currency rate changes.

SG&A expenses for the segment decreased 5% in dollar

t e rms, and from 27.4% of sales in 1998 to 25.2% in 1999,

reflecting the benefits of Consumer Imaging’s sales growth and

cost reduction activities. Excluding advertising expenses, SG&A

expenses decreased 4% , from 18.9% of sales in 1998 to 17.5%

in 1999. R&D expenses decreased 5% , from 5.1% of sales in

1998 to 4.7% in 1999.