Kodak 2000 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2000 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

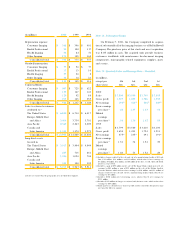

F u rther information relating to options is as follows:

S h a re s

(Amounts in thousands, U n d e r Range of Price

except per share amounts) O p t i o n Per Share

Outstanding on

December 31, 1997 2 4 , 2 0 4 $ 3 0 . 2 5 – $ 9 2 . 3 1

G r a n t e d 1 4 , 5 4 6 $ 5 9 . 0 0 – $ 8 7 . 5 9

E x e rc i s e d 3 , 2 0 8 $ 3 0 . 2 5 – $ 8 2 . 0 0

Te rminated, Canceled

or S urre n d e re d 1 , 2 1 1 $ 3 1 . 4 5 – $ 8 3 . 3 8

Outstanding on

December 31, 1998 3 4 , 3 3 1 $ 3 0 . 2 5 – $ 9 2 . 3 1

G r a n t e d 4 , 2 7 6 $ 6 0 . 1 3 – $ 7 9 . 6 3

E x e rc i s e d 1 , 1 0 1 $ 3 0 . 2 5 – $ 7 4 . 3 1

Te rminated, Canceled

or S urre n d e re d 4 7 3 $ 3 1 . 4 5 – $ 9 2 . 3 1

Outstanding on

December 31, 1999 3 7 , 0 3 3 $ 3 0 . 2 5 – $ 9 2 . 3 1

G r a n t e d 1 2 , 5 3 3 $ 3 7 . 2 5 – $ 6 9 . 5 3

E x e rc i s e d 1 , 3 2 6 $ 3 0 . 2 5 – $ 5 8 . 6 3

Te rminated, Canceled

or S urre n d e re d 3 , 3 9 4 $ 3 1 . 4 5 – $ 9 0 . 5 0

Outstanding on

December 31, 2000 4 4 , 8 4 6 $ 3 2 . 5 0 – $ 9 2 . 3 1

E x e rcisable on

December 31, 2000 2 8 , 7 8 3 $ 3 2 . 5 0 – $ 9 2 . 3 1

P ro forma net earnings and earnings per share information, as

re q u i red by SFAS No. 123, “Accounting for Stock-Based Com-

p e n s a t i o n,” has been determined as if the Company had accounted

for employee stock options under SFAS No. 123’s fair value

method. The fair value of options was estimated at grant date

using a Black-S choles option pricing model with the following

weighted-average assumptions:

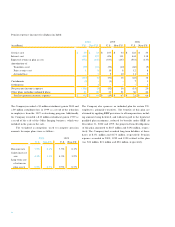

2 0 0 0 1 9 9 9 1 9 9 8

Risk free interest rates 6 . 2 % 5 . 1 % 5 . 6 %

Expected option lives 7 years 7 years 7 years

Expected volatilities 2 9 % 2 8 % 2 7 %

Expected dividend yields 3 . 1 9 % 2 . 7 6 % 2 . 7 1 %

The weighted-average fair value of options granted was $16.79,

$18.77 and $19.94 for 2000, 1999 and 1998, re s p e c t i v e l y.

For purposes of pro forma disclosures, the estimated fair value

of the options is amortized to expense over the options’ vesting

period (2-3 years). The Company’s pro forma information follows:

Year Ended December 31,

(in millions,

except per share data) 2 0 0 0 1 9 9 9 1 9 9 8

Net earn i n g s

As re p o rt e d $1 , 4 0 7 $1 , 3 9 2 $ 1 , 3 9 0

P ro form a 1 , 3 4 6 1 , 2 6 3 1 , 2 7 2

Basic earnings per share

As re p o rt e d $4 . 6 2 $4 . 3 8 $ 4 . 3 0

P ro form a 4 . 4 1 3 . 9 7 3 . 9 4

Diluted earnings per share

As re p o rt e d $4 . 5 9 $4 . 3 3 $ 4 . 2 4

P ro form a 4 . 4 1 3 . 9 6 3 . 9 3