Kodak 2000 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2000 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Note 13: Nonpension Postre t i rement Benefits

The Company provides healthcare, dental and life insurance

benefits to U.S . eligible re t i rees and eligible survivors of re t i re e s .

In general, these benefits are provided to U.S. re t i rees that are

c o v e red by the Company’s KRIP plan. These benefits are funded

f rom the general assets of the Company as they are incurre d .

C e rtain non-U.S. subsidiaries offer healthcare benefits; however,

the cost of such benefits is insignificant to the Company.

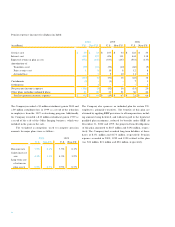

Changes in the Company’s benefit obligation and funded

status are as follows:

(in millions) 2 0 0 0 1 9 9 9

Net benefit obligation at

beginning of year $2 , 3 0 7 $2 , 2 8 0

S e rvice cost 1 2 1 3

I n t e rest cost 1 6 9 1 5 2

Plan participants’ contributions 33

Plan amendments 6 2 ( 3 3 )

Actuarial loss 2 2 9 7 0

C u rt a i l m e n t s 1( 1 3 )

Benefit payments ( 1 8 1 ) ( 1 6 5 )

Net benefit obligation

at end of year $2 , 6 0 2 $2 , 3 0 7

Funded status at end of year $( 2 , 6 0 2 ) $( 2 , 3 0 7 )

U n a m o rtized net loss 7 0 0 4 9 1

U n a m o rtized plan amendments ( 5 1 0 ) ( 6 4 6 )

Net amount recognized and

re c o rded at end of year $( 2 , 4 1 2 ) $( 2 , 4 6 2 )

The weighted-average assumptions used to compute postre t i re-

ment benefit amounts were as follows:

2 0 0 0 1 9 9 9

Discount rate 7 . 5 % 7 . 5 %

S a l a ry increase rate 4 . 3 % 4 . 3 %

H e a l t h c a re cost tre n d( a ) 8 . 0 % 8 . 5 %

( a )d e c reasing to 5.0% by 2007

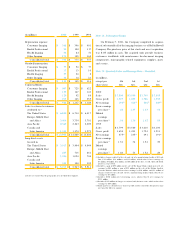

(in millions) 2 0 0 0 1 9 9 9 1 9 9 8

Components of net

p o s t re t i rement

benefit cost

S e rvice cost $1 2 $1 3 $ 1 9

I n t e rest cost 1 6 9 1 5 2 1 6 1

A m o rtization of:

Prior service cost ( 6 7 ) ( 6 8 ) ( 7 0 )

Actuarial loss 1 8 81 6

1 3 2 1 0 5 1 2 6

C u rt a i l m e n t s ( 6 ) ( 9 0 ) ( 1 0 3 )

Total net postre t i rement

benefit cost $1 2 6 $1 5 $ 2 3

The Company re c o rded a $6 million and $71 million gain in 2000

and 1999, re s p e c t i v e l y, as a result of the reduction in employees

in those years from the 1997 re s t ructuring program. Additionally,

the Company re c o rded a $15 million curtailment gain in 1999 as

a result of the sale of the Office Imaging business, which was

included in the gain on the sale, and a $4 million curtailment gain

as part of the investment in the joint venture with NexPre s s .

The Company will no longer fund healthcare and dental ben-

efits for employees who elected to participate in the Company’s

Cash Balance Plus plan, effective January 1, 2000. This change

is not expected to have a material impact on the Company’s future

p o s t re t i rement benefit cost.