Kodak 2000 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2000 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.The Company is in the process of making changes in are a s

such as marketing and pricing, purchasing, contracts, payro l l ,

taxes, cash management and tre a s u ry operations. Under the ‘no

compulsion no prohibition’ rules, billing sys tems have been mod-

ified s o that the Company is now able to show total gross, value

added tax, and net in Euros on national currency invoices. This

enables customers to pay in the new Euro currency if they wish

to do so. C ountries that have installed ERP/SAP software in con-

nection with the Company’s enterprise re s o u rce planning pro j e c t

a re able to invoice and receive payments in Euros as well as in

other currencies. Systems for pricing, payroll and expense re i m-

bursements will continue to use national currencies until year- e n d

2001. The functional currencies of the Company’s operations in

a ffected countries will remain the national currencies until appro x-

imately May 2001 (except Germany and Austria (November

2001)), when they will change to the Euro. Systems changes for

countries not on SAP (Finland and Greece) are also being imple-

mented in 2001.

Liquidity and Capital Resourc e s

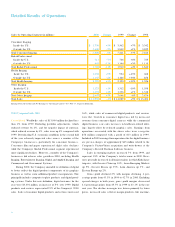

Net cash provided by operating activities in 2000 was $982 mil-

lion, as net earnings of $1,407 million, adjusted for depre c i a t i o n

and amortization, provided $2,296 million of operating cash. This

was partially offset by increases in receivables of $247 million,

l a rgely due to the timing of s ales late in the fourth quart e r ;

i n c reases in inventories of $282 million, reflecting lower than

expected sales perf o rmance in the second half of the year par-

ticularly consumer films and paper and consumer digital camera

sales; and decreases in liabilities (excluding borrowings) of $755

million related primarily to severance payments for re s t ru c t u r i n g

p rograms and reductions in accounts payable and accrued ben-

efit costs. Net cash used in investing activities of $783 million in

2000 was utilized primarily for capital expenditures of $945 mil-

lion and business acquisitions of $130 million, partially offset by

p roceeds of $276 million from sales of businesses/assets. Net

cash used in financing activities of $314 million in 2000 was the

result of stock re p u rchases and dividend payments, larg e l y

funded by net increases in borrowings of $1,313 million.

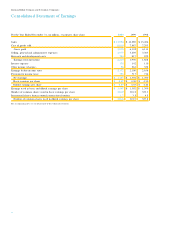

Cash dividends per share of $1.76, payable quart e r l y, were

d e c l a red in each of the years 2000, 1999 and 1998. Total

cash dividends of approximately $545 million, $563 million and

$569 million were paid in 2000, 1999 and 1998, re s p e c t i v e l y.

Net working capital (excluding short - t e rm borro w i n g s )

i n c reased to $1,482 million from $838 million at year-end 1999.

This increase is mainly attributable to lower payable levels and

higher receivable and inventory balances, as discussed above.

Capital additions were $945 million in 2000, with the major-

ity of the spending supporting manufacturing productivity and

quality improvements, new products including e-Commerce initia-

tives, digital photofinishing and digital cameras, and ongoing envi-

ronmental and safety spending. In 2001, the Company expects

to reduce its capital spending (excluding acquisitions) from its

2000 spending levels. Capital additions by segment are included

in Note 17, Segment Inform a t i o n .

Under its stock re p u rchase programs, the Company re p u r-

chased $1,099 million, $925 million and $258 million of its share s

in 2000, 1999 and 1998, re s p e c t i v e l y. During the second quar-

ter of 1999, the Company completed stock re p u rchases under its

1996 $2 billion authorization. That program, initiated in May 1996,

resulted in 26.8 million shares being re p u rchased. Under the

$2 billion program announced on April 15, 1999, the Company

re p u rchased an additional 21.6 million shares for $1,099 million

in 2000 and 9.8 million shares for $656 million in 1999. On

December 7, 2000, Kodak’s board of directors authorized the

re p u rchase of up to an additional $2 billion of the Company’s

stock over the next 4 years.

The C ompany has access to a $3.5 billion revolving cre d i t

facility expiring in November 2001. The Company also has a

shelf registration statement for debt securities with an available

balance of $1.9 billion.

See Note 8, C ommitments and Contingencies, for other

commitments of the Company.

O t h e r

Kodak is subject to various laws and governmental re g u l a t i o n s

c o n c e rning environmental matters. See Note 8, Commitments

and Contingencies.

C a u t i o n a ry Statement Pursuant to Safe Harbor Provisions of

the Private Securities Litigation Reform Act of 1995

C e rtain statements in this re p o rt may be forw a rd-looking in

n a t u re, or “forw a rd-looking statements” as defined in the United

States Private S ecurities Litigation Reform Act of 1995. For

example, re f e rences to the Company’s earnings per share expec-

tations for 2001 are forw a rd-looking statements.

Actual results may differ from those expressed or implied in

f o rw a rd-looking statements. The forw a rd-looking statements con-

tained in this re p o rt are subject to a number of risk factors, includ-

ing: the Company’s ability to implement its product strategies

(including its category expansion and digitization strategies and

its plans for digital products and Advantix products), to develop

38