Kodak 2000 Annual Report Download - page 38

Download and view the complete annual report

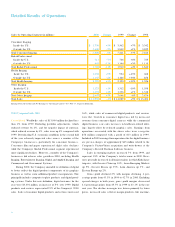

Please find page 38 of the 2000 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.87% , as considerably higher volumes were only partially miti-

gated by lower effective selling prices.

SG&A expenses decreased 17%, from 22.8% of sales in

1998 to 20.6% in 1999. Excluding advertising expens es, SG&A

expenses decreased 19% , from 19.8% of sales in 1998 to

17.4% in 1999. R&D expenses decreased 11% , from 8.0% of

sales in 1998 to 7.7% in 1999.

E a rnings from operations increased 25% in 1999. Excluding

special charges in both 1998 and 1999, earnings from opera-

tions decreased 2% , as higher volumes and manufacturing pro-

ductivity were offset by lower effective selling prices and the

unfavorable effects of exchange. Net earnings increased 37% ,

but decreased 21% excluding special charges and credits fro m

both years. This decrease reflects lower earnings from opera-

tions and lower gains on sales of pro p e rt i e s .

R e s t ructuring Pro g r a m s

The Company re c o rded a $350 million pre-tax re s t ru c t u r i n g

c h a rge in the third quarter of 1999. Actions under this pro g r a m

w e re effectively completed in 2000. The Company re a l i z e d

a p p roximate savings associated with this program of $90 million

in 2000, and expects an additional $50 million of savings in 2001,

resulting in a total annual run-rate savings of $140 million. The

Company anticipates recovering the net cash cost of this pro-

gram in two years. Approximately 2,900 positions were eliminated

worldwide under this program (see Note 11, Restru c t u r i n g

P rograms and Cost Reduction).

O u t l o o k

The Company expects the overall slowdown in the U.S . economy

and the corresponding industry-wide decrease in photographic

activity to continue through the first two quarters of 2001 before

recovering in the s econd half of the year. The Company will con-

tinue to take actions to minimize the financial impact of this slow-

down. These actions include eff o rts to better manage pro d u c t i o n

and inventory levels while at the same time reducing discre t i o n a ry

spending to further hold down costs. The Company will also con-

sider additional actions, including reductions in staff in cert a i n

a reas of the Company, aimed at making its operations more cost

competitive and improving marg i n s .

During 2000, the Company completed an ongoing pro g r a m

of real estate divestitures and portfolio rationalization that con-

tributed to other income (charges) reaching an annual average of

$100 million over the past three years. Now that this program is

l a r gely c omplete, the other income (charges) category is

expected to run in the $0 to negative $50 million range annually.

The Company expects a 1% reduction in its effective tax rate

f rom 34% in 2000 to 33% in 2001. This reduction was re f l e c t e d

in the earnings guidance issued January 17th, 2001.

F rom a liquidity and capital re s o u rce perspective, the

C ompany will look to reduce its debt levels by focusing on

i n c reas ing cash flow, lowering capital spending and re d u c i n g

i n v e n t o ry and receivable levels.

The Euro

The Treaty on European Union provided that an economic and

m o n e t a ry union (EMU) be established in Europe whereby a sin-

gle European curre n c y, the Euro, replaces the currencies of par-

ticipating member states. The Euro was introduced on January 1,

1999, at which time the value of participating member state cur-

rencies was irrevocably fixed against the Euro and the Euro p e a n

C u rrency Unit (EC U) was replaced at the rate of one Euro to one

ECU. For the three-year transitional period ending December 31,

2001, the national currencies of member states will continue to

c i rculate, but as sub-units of the Euro. New public debt will be

issued in Euros and existing debt may be redenominated into

E u ros. At the end of the transitional period, Euro banknotes

and coins will be issued, and the national currencies of the mem-

ber states will cease to be legal tender no later than June 30,

2002. The countries that adopted the Euro on January 1, 1999

a re Austria, Belgium, Finland, France, Germ a n y, Ireland, Italy,

L u x e m b o u rg, The Netherlands, Portugal, and Spain. Greece will

now be part of the transition. The Company has operations in

all of these countries.

As a result of the Euro conversion, it is possible that sell-

ing prices of the Company’s products and services will experi-

ence downward pre s s u re, as current price variations among

countries are reduced due to easy comparability of Euro prices

a c ross countries. Prices will tend to harmonize, although value

added taxes and transportation costs will still justify price diff e r-

entials. Adoption of the Euro will probably accelerate existing

market and pricing trends including pan-European buying and

general price ero s i o n .

On the other hand, currency exchange and hedging costs

will be reduced; lower prices and pan-European buying will ben-

efit the Company in its purchasing endeavors; the number of

banks and suppliers needed will be reduced; there will be less

variation in payment terms; and it will be easier for the Company

to expand into new marketing channels such as mail order and

I n t e rnet marketing.