Kodak 2000 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2000 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

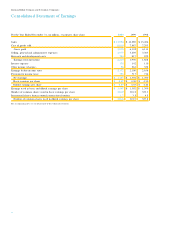

At December 31, (in millions, except share and per share data) 2 0 0 0 1 9 9 9

A s s e t s

C u rrent Assets

Cash and cash equivalents $2 4 6 $3 7 3

Marketable securities 52 0

R e c e i v a b l e s 2 , 6 5 3 2 , 5 3 7

I n v e n t o r i e s 1 , 7 1 8 1 , 5 1 9

D e f e rred income tax charg e s 5 7 5 6 8 9

O t h e r 2 9 4 3 0 6

Total current assets 5 , 4 9 1 5 , 4 4 4

P ro p e rt i e s

Land, buildings and equipment at cost 1 2 , 9 6 3 1 3 , 2 8 9

Les s: Accumulated depre c i a t i o n 7 , 0 4 4 7 , 3 4 2

Net pro p e rt i e s 5 , 9 1 9 5 , 9 4 7

Other Assets

Goodwill (net of accumulated amortization of $778 and $671) 9 4 7 9 8 2

L o n g - t e rm receivables and other noncurrent assets 1 , 7 6 7 1 , 8 0 1

D e f e rred income tax charg e s 8 8 1 9 6

Total Assets $1 4 , 2 1 2 $1 4 , 3 7 0

Liabilities and Shareholders’ Equity

C u rrent Liabilities

P a y a b l e s $3 , 2 7 5 $3 , 8 3 2

S h o rt - t e rm borro w i n g s 2 , 2 0 6 1 , 1 6 3

Taxes — income and other 5 7 2 6 1 2

Dividends payable 1 2 8 1 3 9

D e f e rred income tax cre d i t s 3 4 2 3

Total current liabilities 6 , 2 1 5 5 , 7 6 9

Other Liabilities

L o n g - t e rm borro w i n g s 1 , 1 6 6 9 3 6

Postemployment liabilities 2 , 6 1 0 2 , 7 7 6

Other long-term liabilities 7 3 2 9 1 8

D e f e rred income tax cre d i t s 6 1 5 9

Total Liabilities 1 0 , 7 8 4 1 0 , 4 5 8

S h a reholders ’ Equity

Common stock, par value $2.50 per share 950,000,000 shares authorized;

issued 391,292,760 shares in 2000 and 1999 9 7 8 9 7 8

Additional paid in capital 8 7 1 8 8 9

Retained earn i n g s 7 , 8 6 9 6 , 9 9 5

Accumulated other comprehensive loss ( 4 8 2 ) ( 1 4 5 )

9 , 2 3 6 8 , 7 1 7

Tre a s u ry stock, at cost 100,808,494 shares in 2000 and 80,871,830 shares in 1999 5 , 8 0 8 4 , 8 0 5

Total Shareholders’ Equity 3 , 4 2 8 3 , 9 1 2

Total Liabilities and Shareholders’ Equity $1 4 , 2 1 2 $1 4 , 3 7 0

The accompanying notes are an integral part of these financial statements.

Eastman Kodak Company and Subsidiary Companies

Consolidated Statement of Financial Position