Hasbro 2006 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2006 Hasbro annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

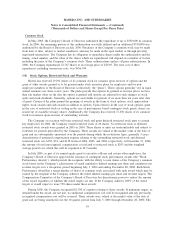

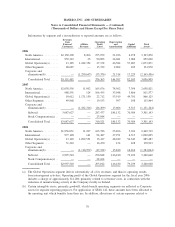

Expected benefit payments under the defined benefit pension plans and expected gross benefit payments

and subsidy receipts under the postretirement benefit plan for the next five years subsequent to 2006 and in

the aggregate for the following five years are as follows:

Pension

Gross

Benefit

Payments

Subsidy

Receipts

Postretirement

2007. . . ............................................ $ 17,685 2,666 271

2008. . . ............................................ 19,283 2,750 282

2009. . . ............................................ 19,346 2,815 290

2010. . . ............................................ 18,977 2,887 292

2011. . . ............................................ 19,614 2,937 290

2012-2016 .......................................... 118,325 14,577 1,285

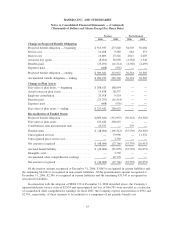

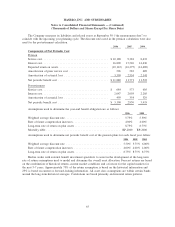

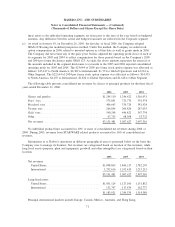

Assumptions used to determine the net periodic benefit cost of the postretirement plans for the year to

date period are as follows:

2006 2005 2004

Health care cost trend rate assumed for next year .................... 10.00% 9.00% 10.00%

Rate to which the cost trend rate is assumed to decline (ultimate trend

rate) ................................................... 5.00% 5.00% 5.00%

Year that the rate reaches the ultimate trend rate..................... 2012 2011 2009

If the health care cost trend rate were increased one percentage point in each year, the accumulated

postretirement benefit obligation at December 31, 2006 and the aggregate of the benefits earned during the

period and the interest cost would have each increased by approximately 5% and 5%, respectively.

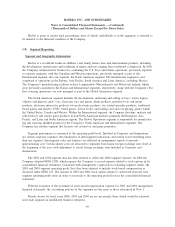

International Plans

Pension coverage for employees of Hasbro’s international subsidiaries is provided, to the extent deemed

appropriate, through separate defined benefit and defined contribution plans. At December 31, 2006 and

December 25, 2005, the defined benefit plans had total projected benefit obligations of $73,333 and $58,206,

respectively, accumulated benefit obligations of $62,893 and $46,557, respectively, and fair values of plan

assets of $55,429 and $40,397, respectively. Substantially all of the plan assets are invested in equity and fixed

income securities. The pension expense related to these plans was $3,702 for fiscal 2006 and $3,073 for fiscal

2005. In connection with the adoption of SFAS 158 at December 31, 2006 described above, the Company’s

unamortized prior service costs of $443, unrecognized net loss of $9,710 and unrecognized transition

obligation of $277 were recorded as a reduction of accumulated other comprehensive earnings. In fiscal 2007,

the Company expects amortization of $96, $231 and $45, respectively, of these amounts to be included as a

component of net periodic benefit cost. At December 25, 2005, the Company had recorded an additional

minimum pension liability related to these international plans of $3,100. This additional minimum pension

liability was partially offset by an intangible asset in the amount of $206 at December 25, 2005. The

remaining amount of $2,894 was recorded as a separate component of accumulated other comprehensive

earnings, along with related deferred taxes of $902. Assumptions used to calculate the benefit obligations and

pension expense for these plans vary depending on each plan and are based on factors specific to each

country.

66

HASBRO, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements — (Continued)

(Thousands of Dollars and Shares Except Per Share Data)