Hasbro 2006 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2006 Hasbro annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

weighted average grant-date fair value of each Stock Performance Awards was $19.00. Forfeitures of these

awards during 2006 were 24. At December 31, 2006, the amount of total unrecognized compensation cost

related to these awards is approximately $11,317 and the weighted average period over which this will be

expensed is 24 months.

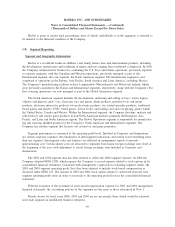

Prior to fiscal 2006, Hasbro used the intrinsic-value method of accounting for stock options granted to

employees and non-employee members of the Board of Directors. Effective December 26, 2005, the first day

of fiscal 2006, the Company adopted SFAS 123R under the modified prospective transition method as defined

in the statement. Under this adoption method, the Company recorded stock option expense in 2006 based on

all unvested stock options as of the adoption date and any stock option awards made subsequent to the

adoption date. Stock-based compensation is recognized on a straight-line basis over the requisite service period

of the award. In accordance with the modified prospective transition method, the Company’s consolidated

financial statements for prior years have not been restated to reflect, and do not include, the impact of

SFAS 123R.

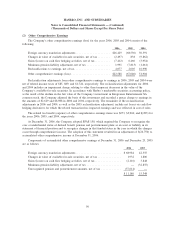

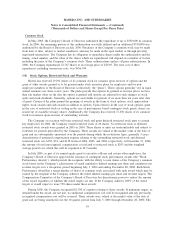

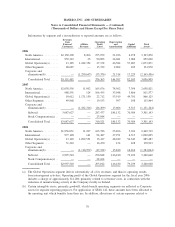

Total compensation expense related to stock options and the stock performance awards recognized under

SFAS 123R for the year ended December 31, 2006 was $21,684 and was recorded as follows:

Cost of sales .......................................................... $ 306

Research and product development .......................................... 1,436

Selling, distribution and administration ....................................... 19,942

21,684

Income taxes .......................................................... 7,399

$14,285

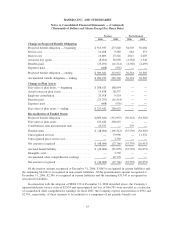

Information with respect to stock options for the three years ended December 31, 2006 is as follows:

2006 2005 2004

Outstanding at beginning of year ............................ 20,443 21,041 19,261

Granted ............................................. 3,126 2,953 4,956

Exercised ........................................... (5,490) (3,020) (1,865)

Expired or canceled .................................... (770) (531) (1,311)

Outstanding at end of year ............................... 17,309 20,443 21,041

Exercisable at end of year ............................... 11,016 14,015 12,570

Weighted average exercise price:

Granted ............................................. $ 18.83 20.55 19.35

Exercised ........................................... $ 16.00 15.00 14.28

Expired or canceled .................................... $ 24.38 25.07 20.59

Outstanding at end of year ............................... $ 19.73 19.04 18.40

Exercisable at end of year ............................... $ 19.94 19.29 19.24

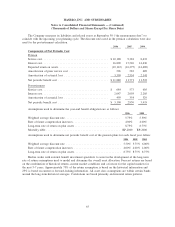

With respect to the 17,309 outstanding options and 11,016 options exercisable at December 31, 2006, the

weighted average remaining contractual life of these options was 5.29 years and 4.66 years, respectively. The

aggregate intrinsic value of the options outstanding and exercisable at December 31, 2006 was $140,257 and

$90,630, respectively.

60

HASBRO, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements — (Continued)

(Thousands of Dollars and Shares Except Per Share Data)