Hasbro 2006 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2006 Hasbro annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

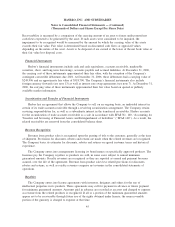

less allowances, approximates fair value. Variations in the credit and discount assumptions would not

significantly impact fair value.

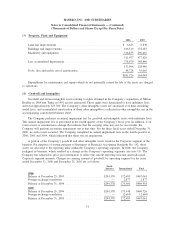

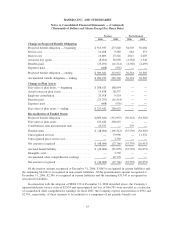

(6) Accrued Liabilities

2006 2005

Liabilities potentially settleable in common stock ...................... $155,630 123,860

Royalties ................................................... 76,695 84,765

Advertising .................................................. 74,781 75,515

Payroll and management incentives ................................ 76,653 64,583

Accrued income taxes .......................................... 121,254 130,007

Other ...................................................... 230,283 232,082

$735,296 710,812

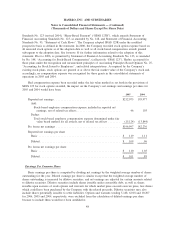

The Company currently has a warrant amendment agreement with Lucas Licensing Ltd. and Lucasfilm

Ltd. that provides the Company with a call option through October 13, 2016 to purchase all of these warrants

from Lucas for a price to be paid at the Company’s election of either $200,000 in cash or the equivalent of

$220,000 in shares of the Company’s common stock, such stock being valued at the time of the exercise of the

option. Also, the warrant amendment agreement provides Lucas with a put option through January 2008 to sell

all of these warrants to the Company for a price to be paid at the Company’s election of either $100,000 in

cash or the equivalent of $110,000 in shares of the Company’s common stock, such stock being valued at the

time of the exercise of the option.

The Company adjusts these warrants to their fair value through earnings at the end of each reporting

period. During 2006, 2005, and 2004, the Company recorded (income) expense of $31,770, $(2,080), and

$(12,710), respectively, to adjust the warrants to their fair value. This (income) expense is included in other

(income) expense, net in the consolidated statement of operations. There is no tax benefit or expense

associated with the fair value adjustments.

Should either the put or call option be required to be settled, the Company believes that it will have

adequate funds available to settle them in cash if necessary. Had this option been exercised at December 31,

2006 and the Company had elected to settle this option in the Company’s stock, the Company would have

been required to issue 4,078 shares. If the share price of the Company’s common stock were higher as of

December 31, 2006 the number of shares issuable would have decreased. If the share price were lower as of

December 31, 2006, the number of shares issuable would have increased.

54

HASBRO, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements — (Continued)

(Thousands of Dollars and Shares Except Per Share Data)