Hasbro 2006 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2006 Hasbro annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

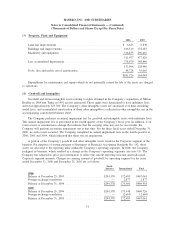

day period ending on the last trading day of the calendar quarter, the holders have the right to convert the

notes to shares of the Company’s common stock at the initial conversion price of $21.60 in the next calendar

quarter. At December 31, 2006, this contingent conversion feature was met and the debentures are convertible

through March 31, 2007, at which time the contingent conversion feature will be reassessed. In addition, if the

closing price of the Company’s stock exceeds $27.00 for at least 20 trading days in any 30 day period, the

Company has the right to call the debentures by giving notice to the holders of the debentures. During a

prescribed notice period, the holders of the debentures have the right to convert their debentures in accordance

with the conversion terms described above. The holders of these debentures may also put the notes back to

Hasbro in December 2011 and December 2016. At these times, the purchase price may be paid in cash, shares

of common stock or a combination of the two, at the discretion of the Company.

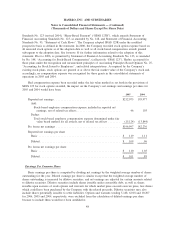

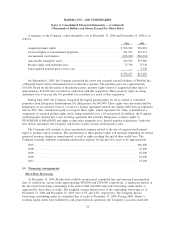

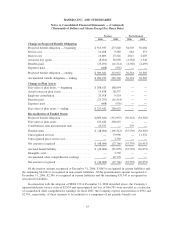

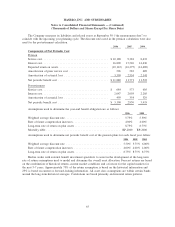

(8) Income Taxes

Income taxes attributable to earnings before income taxes are:

2006 2005 2004

Current

United States ....................................... $ 34,049 76,642 3,786

State and local ...................................... 3,203 7,147 (497)

International ....................................... 49,200 39,081 26,198

86,452 122,870 29,487

Deferred

United States ....................................... 24,912 (20,611) 28,019

State and local ...................................... 2,135 (1,767) 2,402

International ....................................... (2,080) (1,654) 4,203

24,967 (24,032) 34,624

$111,419 98,838 64,111

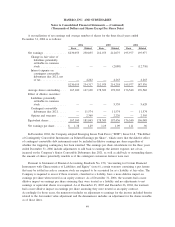

On October 22, 2004, the American Jobs Creation Act of 2004 (the “Act”) was signed into law. The Act

created a one-time incentive for U.S. corporations to repatriate undistributed earnings from their international

subsidiaries by providing an 85% dividends-received deduction for certain international earnings. The

deduction was available to corporations during the tax year that includes October 22, 2004 or in the

immediately subsequent tax year. In the fourth quarter of 2005, the Company’s Board of Directors approved a

plan to repatriate approximately $547,000 in foreign earnings, which was completed in December 2005. The

tax expense related to this repatriation was $25,844.

Certain tax benefits (expenses) are not reflected in income taxes in the statements of operations. Such

benefits of $27,876 in 2006, $8,426 in 2005, and $6,675 in 2004, relate primarily to stock options. In 2006,

2005 and 2004, the deferred tax portion of the total benefit (expense) was $12,917, $4,563, and $(283),

respectively.

56

HASBRO, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements — (Continued)

(Thousands of Dollars and Shares Except Per Share Data)