Hasbro 2006 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2006 Hasbro annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

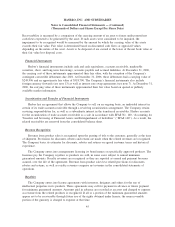

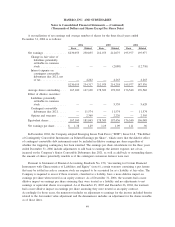

The Company records an allowance for doubtful accounts at the time revenue is recognized based on

management’s assessment of the business environment, customers’ financial condition, historical collection

experience, accounts receivable aging and customer disputes. When a significant event occurs, such as a

bankruptcy filing by a specific customer, and on a quarterly basis, the allowance is reviewed for adequacy and

the balance or accrual rate is adjusted to reflect current risk prospects.

Inventories

Inventories are valued at the lower of cost (first-in, first-out) or market. Based upon a consideration of

quantities on hand, actual and projected sales volume, anticipated product selling price and product lines

planned to be discontinued, slow-moving and obsolete inventory is written down to its net realizable value.

At December 31, 2006 and December 25, 2005, finished goods comprised 92% and 89% of inventories,

respectively.

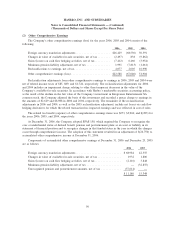

Long-Lived Assets

The Company’s long-lived assets consist of property, plant and equipment, goodwill and intangible assets

with indefinite lives as well as other intangible assets the Company considers to have a defined life.

Goodwill results from purchase method acquisitions the Company has made over time. Substantially all

of the other intangibles consist of the cost of acquired product rights. In establishing the value of such rights,

the Company considers, but does not individually value, existing trademarks, copyrights, patents, license

agreements and other product-related rights. These rights were valued at their acquisition date based on the

anticipated future cash flows from the underlying product line. The Company has certain intangible assets

related to the Tonka and Milton Bradley acquisitions that have an indefinite life, and amortization of these

assets has been suspended until a remaining useful life can be determined.

Goodwill and intangible assets deemed to have indefinite lives are not amortized and are tested for

impairment at least annually. The annual test begins with goodwill and all intangible assets being allocated to

applicable reporting units. Goodwill is then tested using a two-step process that begins with an estimation of

fair value of the reporting unit using an income approach, which looks to the present value of expected future

cash flows. The first step is a screen for potential impairment while the second step measures the amount of

impairment if there is an indication from the first step that one exists. Intangible assets with indefinite lives

are tested annually for impairment by comparing their carrying value to their estimated fair value, also

calculated using the present value of expected future cash flows.

The remaining intangibles having defined lives are being amortized over three to twenty-five years,

primarily using the straight-line method. Approximately 9% of other intangibles relate to rights acquired in

connection with a major motion picture entertainment property and are being amortized over the contract life,

in proportion to projected sales of the licensed products during the same period.

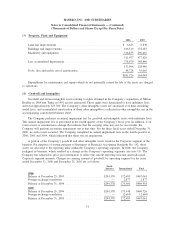

Property, plant and equipment are stated at cost less accumulated depreciation and amortization.

Depreciation and amortization are computed using accelerated and straight-line methods to amortize the cost

of property, plant and equipment over their estimated useful lives. The principal lives, in years, used in

determining depreciation rates of various assets are: land improvements 15 to 19, buildings and improvements

15 to 25 and machinery and equipment 3 to 12. Tools, dies and molds are amortized over a three-year period

or their useful lives, whichever is less, using an accelerated method. The Company generally owns all tools,

dies and molds related to its products.

The Company reviews property, plant and equipment and other intangibles with defined lives for

impairment whenever events or changes in circumstances indicate the carrying value may not be recoverable.

44

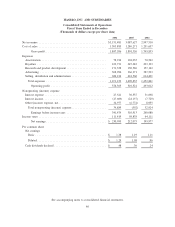

HASBRO, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements — (Continued)

(Thousands of Dollars and Shares Except Per Share Data)