Hasbro 2006 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2006 Hasbro annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

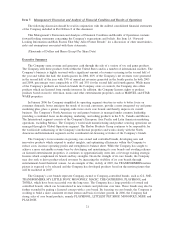

interest in cash. We may not have sufficient cash at that time to make the required repurchases and may be

required to settle in shares of common stock.

We previously issued warrants that provide the holder with an option through January 2008 to sell all of

these warrants to us for a price to be paid, at our election, of either $100,000 in cash or $110,000 in our

common stock, such stock being valued at the time of the exercise of the option. Should we be required to

settle these warrants under this option, we believe that we will have adequate funds to settle in cash if

necessary. However, we may not have sufficient funds at that time to make the required payment and may be

required to settle the warrants in stock.

As a manufacturer of consumer products and a large multinational corporation, we are subject to various

government regulations, violation of which could subject us to sanctions. In addition, we could be the

subject of future product liability suits or product recalls, which could harm our business.

As a manufacturer of consumer products, we are subject to significant government regulations under The

Consumer Products Safety Act, The Federal Hazardous Substances Act, and The Flammable Fabrics Act. In

addition, certain of our products are subject to regulation by the Food and Drug Administration. While we

take all the steps we believe are necessary to comply with these acts, there can be no assurance that we will

be in compliance in the future. Failure to comply could result in sanctions which could have a negative impact

on our business, financial condition and results of operations. We may also be subject to involuntary product

recalls or may voluntarily conduct a product recall. While costs associated with product recalls have generally

not been material to our business, the costs associated with future product recalls individually and in the

aggregate in any given fiscal year, could be significant. In addition, any product recall, regardless of direct

costs of the recall, may harm consumer perceptions of our products and have a negative impact on our future

sales and results of operations.

In addition to government regulation, products that have been or may be developed by us may expose us

to potential liability from personal injury or property damage claims by the users of such products. There can

be no assurance that a claim will not be brought against us in the future. While we currently maintain product

liability insurance coverage in amounts we believe sufficient for our business risks, we may not be able to

maintain such coverage or such coverage may not be adequate to cover all potential claims. Moreover, even if

we maintain sufficient insurance coverage, any successful claim could significantly harm our business,

financial condition and results of operations.

As a large, multinational corporation, we are subject to a host of governmental regulations throughout the

world, including antitrust, customs and tax requirements, anti-boycott regulations and the Foreign Corrupt

Practices Act. Our failure to successfully comply with any such legal requirements could subject us to

monetary liabilities and other sanctions that could harm our business and financial condition.

We have a material amount of goodwill which, if it becomes impaired, would result in a reduction in our

net income.

Goodwill is the amount by which the cost of an acquisition accounted for using the purchase method

exceeds the fair value of the net assets we acquire. Current accounting standards require that goodwill no

longer be amortized but instead be periodically evaluated for impairment based on the fair value of the

reporting unit. At December 31, 2006, approximately $469,938 or 15.2%, of our total assets represented

goodwill. Declines in our profitability may impact the fair value of our reporting units, which could result in a

write-down of our goodwill. Reductions in our net income caused by the write-down of goodwill could harm

our results of operations.

Item 1B. Unresolved Staff Comments

None

15