Hasbro 2006 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2006 Hasbro annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

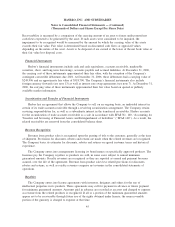

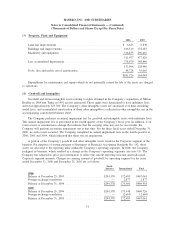

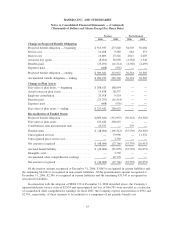

(7) Long-Term Debt

Components of long-term debt are as follows:

2006 2005

8.50% Notes Due 2006 ......................................... $ — 32,743

6.15% Notes Due 2008 ......................................... 135,092 135,092

2.75% Debentures Due 2021 ..................................... 249,996 249,996

6.60% Notes Due 2028 ......................................... 109,895 109,895

Total principal amount of long-term debt ............................ 494,983 527,726

Fair value adjustment related to interest rate swaps .................... (66) 663

Total long-term debt ........................................... 494,917 528,389

Less current portion ........................................... — 32,770

Long-term debt excluding current portion ........................... $494,917 495,619

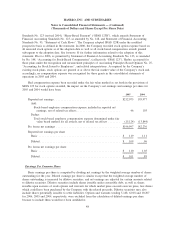

The schedule of contractual maturities of long-term debt for the next five years and thereafter is as

follows:

2007 ............................................................... $ —

2008 ............................................................... 135,092

2009 ............................................................... —

2010 ............................................................... —

2011 ............................................................... —

Thereafter ........................................................... 359,891

$494,983

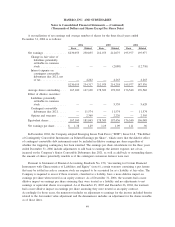

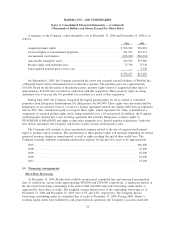

In 2006, the Company repaid in principal amount $32,743 of 8.50% Notes due in March 2006.

During 2004, the Company repurchased an aggregate of $55,658 in principal amount of long-term debt,

comprised of $19,105 in principal amount of 6.60% Debentures due 2028, $10,908 in principal amount of

6.15% Notes due 2008, and $25,645 in principal amount of 5.60% Notes due 2005. The Company recorded a

loss on repurchase of $1,277, which is included in other (income) expense, net in the accompanying

consolidated statements of operations.

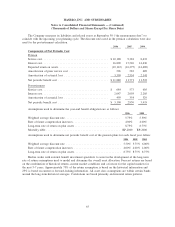

The Company is party to interest rate swap agreements in order to adjust the amount of total debt that is

subject to fixed interest rates. The interest rate swaps are matched with specific long-term debt obligations and

accounted for as fair value hedges of those debt obligations. At December 31, 2006, these interest rate swaps

had a total notional amount of $75,000 with maturities in 2008. In each of the contracts, the Company receives

payments based upon a fixed interest rate that matches the interest rate of the debt being hedged and makes

payments based upon a floating rate based on Libor. These contracts are designated and effective as hedges of

the change in the fair value of the associated debt. At December 31, 2006, these contracts had unrealized

losses of $66, which are included in other liabilities, with a corresponding fair value adjustment to decrease

long-term debt.

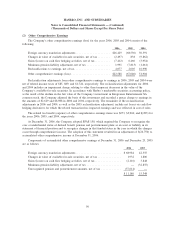

The Company currently has $249,996 outstanding in principal amount of contingent convertible

debentures due 2021. These debentures bear interest at 2.75%, which could be subject to an upward

adjustment commencing in December 2005 depending on the price of the Company’s stock. If the closing

price of the Company’s stock exceeds $23.76 for at least 20 trading days, within the 30 consecutive trading

55

HASBRO, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements — (Continued)

(Thousands of Dollars and Shares Except Per Share Data)