Hasbro 2006 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2006 Hasbro annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

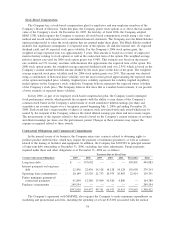

increase in administration costs in dollars in 2005 over 2004 primarily reflected increased performance

incentive bonus provisions reflecting the Company’s improved performance.

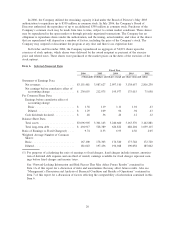

Interest Expense

Interest expense continued to decrease in 2006 to $27,521 from $30,537 in 2005 and $31,698 in 2004.

Decreases in interest expense resulting from lower levels of debt were partially offset by increases resulting

from higher interest rates in 2006. The decrease in interest expense mainly reflects the reduction in the

Company’s long-term debt. The Company repurchased or repaid principal amounts of long-term debt of

$32,743 in 2006, $93,303 in 2005, and $56,697 in 2004. The Company will continue to review the amount of

long-term debt outstanding as part of its strategic capital structure objective of maintaining a debt to

capitalization ratio between 25% and 30%.

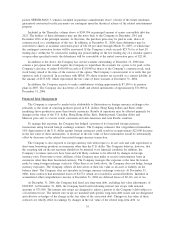

Interest Income

Interest income was $27,609 in 2006 compared to $24,157 in 2005 and $7,729 in 2004. Interest income

includes $5,200 in 2006 related to a long-term deposit that was refunded during 2006 and approximately

$4,100 in 2005 related to an IRS settlement. The increase in interest income reflects the Company’s strong

financial position. During a portion of 2006, the Company invested excess cash in auction rate securities,

which generated a higher rate of return and contributed to the increase in interest income in 2006. In recent

years the Company has reduced its long-term debt which has reduced cash required to service debt and

allowed the Company to retain and invest excess cash.

Other (Income) Expense, Net

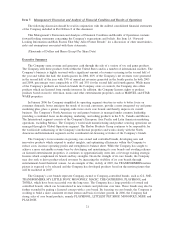

Other (income) expense, net of $34,977 in 2006 compares to $(6,772) in 2005 and $8,955 in 2004. The

major component of other (income) expense is non-cash (income) expense related to the change in fair value

of certain warrants required to be classified as a liability. These warrants are required to be adjusted to their

fair value each quarter through earnings. For 2006, 2005 and 2004, expense (income) related to the change in

fair value of these warrants was $31,770, $(2,080) and $(12,710), respectively. The fair value of these warrants

is primarily affected by the Company’s stock price, but is also affected by the Company’s stock price volatility

and dividends, as well as risk-free interest rates. Assuming the Company’s stock volatility and dividend

payments, as well as risk-free interest rates remain constant, the fair value of the warrants would increase and

the Company would recognize a charge to earnings as the price of the Company’s stock increases. If the price

of the Company’s stock decreases and the Company’s stock volatility, dividend payments, and the risk-free

interest rates remain constant, the fair value of the warrants will decrease and the Company will recognize

income. Based on a hypothetical increase in the Company’s stock price to $30.00 per share at December 31,

2006 from its actual price of $27.25 a share on that date, the Company would have recognized a non-cash

charge of approximately $52,190 rather than actual non-cash charge recorded of $31,770 for the year ended

December 31, 2006, to reflect the change in the fair value of the warrants from their fair value of $123,860 at

December 25, 2005.

In addition to the above, other (income) expense, net in 2006 and 2004 also include $2,629 and $8,988,

respectively, representing write-downs of the value of the common stock of Infogrames, held by the Company

as an available-for-sale investment. This write-down resulted from an other-than-temporary decline in the fair

value of this investment.

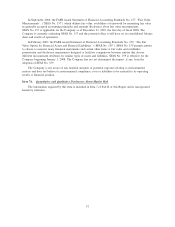

Income Taxes

Income tax expense was 32.6% of pretax earnings in 2006 compared with 31.8% of pretax earnings in

2005 and 24.6% of pretax earnings in 2004. Income tax expense for 2006 includes approximately $7,800 of

discrete tax events, primarily relating to the settlement of various tax exams in multiple jurisdictions. Income

tax expense for 2005 includes approximately $25,800 related to the repatriation of $547,000 of foreign

earnings pursuant to the special incentive provided by the American Jobs Creation Act of 2004. Income tax

expense for 2005 was also reduced by approximately $4,000, due primarily to the settlement of an Internal

27