Hasbro 2006 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2006 Hasbro annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.fourth quarter, close to the holiday season. As a consequence, the majority of our sales to our customers occur

in the period from September through December, as our customers do not want to maintain large on-hand

inventories throughout the year to meet consumer demand. While these techniques reduce a retailer’s

investment in inventory, they increase pressure on suppliers like us to fill orders promptly and thereby shift a

significant portion of inventory risk and carrying costs to the supplier.

The limited inventory carried by retailers may also reduce or delay retail sales, resulting in lower

revenues for us. If we or our customers determine that one of our products is more popular at retail than was

originally anticipated, we may not have sufficient time to produce and ship enough additional product to fully

capture consumer interest in the product. Additionally, the logistics of supplying more and more product

within shorter time periods increases the risk that we will fail to achieve tight and compressed shipping

schedules, which also may reduce our sales and harm our financial performance. This seasonal pattern requires

significant use of working capital, mainly to manufacture or acquire inventory during the portion of the year

prior to the holiday season, and requires accurate forecasting of demand for products during the holiday season

in order to avoid losing potential sales of popular products or producing excess inventory of products that are

less popular with consumers. Our failure to accurately predict and respond to consumer demand, resulting in

our underproducing popular items and/or overproducing less popular items, would reduce our total sales and

harm our results of operations. In addition, as a result of the seasonal nature of our business, we would be

significantly and adversely affected, in a manner disproportionate to the impact on a company with sales

spread more evenly throughout the year, by unforeseen events, such as a terrorist attack or economic shock,

that harm the retail environment or consumer buying patterns during our key selling season, or by events, such

as strikes or port delays, that interfere with the shipment of goods, particularly from the Far East, during the

critical months leading up to the holiday purchasing season.

The continuing consolidation of our retail customer base means that economic difficulties or changes in

the purchasing policies of our major customers could have a significant impact on us.

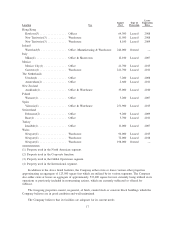

We depend upon a relatively small retail customer base to sell the majority of our products. For the fiscal

year ended December 31, 2006, Wal-Mart Stores, Inc., Target Corporation, and Toys ‘R Us, Inc., accounted

for approximately 24%, 13% and 11%, respectively, of our consolidated net revenues and our five largest

customers, including Wal-Mart, Target and Toys ‘R Us, in the aggregate accounted for approximately 53% of

our consolidated net revenues. These net revenues were primarily related to the North American segment.

While the consolidation of our customer base may provide certain benefits to us, such as potentially more

efficient product distribution and other decreased costs of sales and distribution, this consolidation also means

that if one or more of our major customers were to experience difficulties in fulfilling their obligations to us,

cease doing business with us, significantly reduce the amount of their purchases from us or return substantial

amounts of our products, it could harm our business, financial condition and results of operations. Increased

concentration among our customers could also negatively impact our ability to negotiate higher sales prices for

our products and could result in lower gross margins than would otherwise be obtained if there were less

consolidation among our customers. In addition, the bankruptcy or other lack of success of one or more of our

significant retail customers could negatively impact our revenues and bad debt expense.

We may not realize the full benefit of our licenses if the licensed material has less market appeal than

expected or if sales revenue from the licensed products is not sufficient to earn out the minimum

guaranteed royalties.

An important part of our business involves obtaining licenses to produce products based on various

entertainment properties and theatrical releases, such as those based upon MARVEL or STAR WARS

characters. The license agreements we enter to obtain these rights usually require us to pay minimum royalty

guarantees that may be substantial, and in some cases may be greater than what we are ultimately able to

recoup from actual sales, which could result in write-offs of significant amounts which in turn would harm our

results of operations. At December 31, 2006, we had $181,561 of prepaid royalties, $116,792 of which are

included in prepaid expenses and other current assets and $64,769 of which are included in other assets. Under

the terms of existing contracts as of December 31, 2006, we may be required to pay future minimum

10