Hasbro 2006 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2006 Hasbro annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

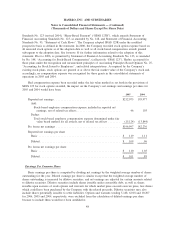

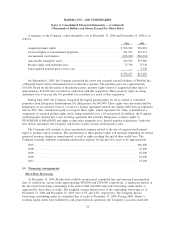

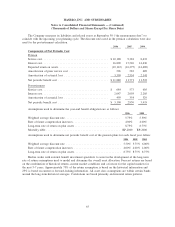

A reconciliation of the statutory United States federal income tax rate to Hasbro’s effective income tax

rate is as follows:

2006 2005 2004

Statutory income tax rate . ...................................... 35.0% 35.0% 35.0%

State and local income taxes, net ................................. 1.2 0.8 0.5

One time dividend ............................................ — 8.3 —

Tax on international earnings .................................... (9.7) (12.2) (12.9)

Fair value adjustment of liabilities potentially settleable in common stock . . . 3.3 (0.2) (1.7)

Change in valuation allowance ................................... 0.8 — 2.7

Settlement of tax examinations................................... 1.5 (1.4) —

Other, net .................................................. 0.5 1.5 1.0

32.6% 31.8% 24.6%

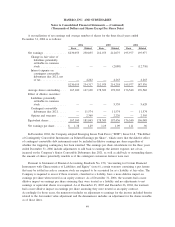

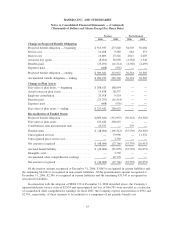

The components of earnings before income taxes, determined by tax jurisdiction, are as follows:

2006 2005 2004

United States ........................................ $113,761 98,180 71,759

International ........................................ 227,713 212,733 188,329

$341,474 310,913 260,088

The components of deferred income tax expense arise from various temporary differences and relate to

items included in the statements of operations.

The tax effects of temporary differences that give rise to significant portions of the deferred tax assets

and liabilities at December 31, 2006 and December 25, 2005 are:

2006 2005

Deferred tax assets:

Accounts receivable.......................................... $ 19,287 25,477

Inventories ................................................ 17,860 21,454

Losses and tax credit carryforwards .............................. 34,405 36,574

Operating expenses .......................................... 62,392 56,667

Pension ................................................... 27,663 35,946

Deferred compensation and stock options .......................... 16,251 9,023

Postretirement benefits........................................ 14,128 11,197

Other .................................................... 26,453 26,450

Gross deferred tax assets .................................... 218,439 222,788

Valuation allowance.......................................... (27,808) (23,333)

Net deferred tax assets ...................................... 190,631 199,455

Deferred tax liabilities:

Convertible debentures ....................................... 32,149 24,784

Depreciation and amortization of long-lived assets ................... 9,658 14,337

Other .................................................... 655 880

Deferred tax liabilities ........................................ 42,462 40,001

Net deferred income taxes ....................................... $148,169 159,454

57

HASBRO, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements — (Continued)

(Thousands of Dollars and Shares Except Per Share Data)