Hasbro 2006 Annual Report Download - page 40

Download and view the complete annual report

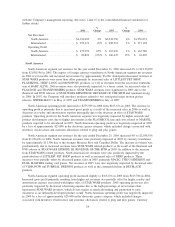

Please find page 40 of the 2006 Hasbro annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.approximately $87,400 is recorded in prepaid assets and $12,930 is shown in long-term assets at December 31,

2006. Prepaid expenses and other current assets decreased to $185,297 in 2005 from $219,735 in 2004. This

decrease is primarily related to decreased prepaid royalties as a result of the increased sales of STAR WARS

products in 2005. Generally, when the Company enters into a licensing agreement for entertainment-based

properties, an advance royalty payment is required at the inception of the agreement. This payment is then

recognized in the consolidated statement of operations as the related sales are recorded. The decrease related

to prepaid royalties was partially offset by increased deferred taxes. With respect to the MARVEL and STAR

WARS licenses, the Company has prepaid royalties recorded in both current and non-current assets.

Accounts payable and accrued expenses increased to $895,311 at December 31, 2006 from $863,280 at

December 25, 2005. $31,770 of this increase relates to the increase in fair value of the Lucas warrants that the

Company is required to record as liabilities under SFAS 150. As a result of SFAS 150, the Company classifies

these warrants containing a put option as a current liability and adjusts the amount of this liability to its fair

value on a periodic basis. Increases from higher accrued bonus and incentive payments as a result of the

Company’s strong performance in 2006 were offset by decreases in other accrued amounts, principally accrued

royalties. Accounts payable and accrued expenses increased to $863,280 at December 25, 2005 from $806,528

at December 26, 2004. This primarily reflected an increase in accrued income taxes primarily as a result of

improved earnings in 2005 and, to a lesser extent, taxes payable related to earnings repatriated under the

American Jobs Creation Act (the “Act”). In December 2005, the Company repatriated approximately $547,000

under this Act. The increase from accrued income taxes was partially offset by lower accrued royalties at

December 25, 2005 due to lower sales of BEYBLADE and SHREK products in the fourth quarter of 2005.

These contracts did not require the Company to prepay royalties and these amounts were paid in arrears.

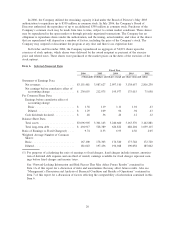

Cash flows from investing activities were a net utilization of $83,604, $120,671, and $84,967 in 2006,

2005, and 2004, respectively. During 2005, the Company expended $65,000 to reacquire the digital gaming

rights for its owned or controlled properties from Infogrames Entertainment SA (Infogrames). These rights

were previously held by Infogrames on an exclusive basis as a result of a licensing agreement entered into

during 2000. In addition, the Company expended $14,179 to purchase the assets of Wrebbit Inc., a Montreal-

based creator and manufacturer of innovative puzzles. In 2005, the Company also had proceeds from the sales

of property, plant and equipment of $33,083. These proceeds came primarily from the sale of the Company’s

former manufacturing facility in Spain. During 2006, the Company expended approximately $82,000 on

additions to its property, plant and equipment while during 2005 and 2004 it expended approximately $71,000

and $79,000, respectively. Of these amounts, 63% in 2006, 61% in 2005, and 58% in 2004 were for purchases

of tools, dies and molds related to the Company’s products. In 2007, the Company expects capital expenditures

to increase and be in the range of $90,000 to $110,000, primarily as the result of increased tooling

requirements for the MARVEL line. During the three years ended December 31, 2006, depreciation and

amortization of plant and equipment was $67,773, $78,097, and $75,618, respectively. In 2004, the Company

acquired the remaining unowned interest in its Latin America operations for total consideration of $9,824. This

purchase resulted in an increase in goodwill in the amount of $9,390. The Company made no acquisitions of

businesses in 2006.

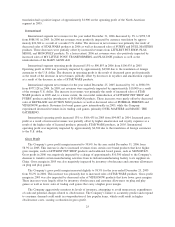

The Company commits to inventory production, advertising and marketing expenditures prior to the peak

third and fourth quarter retail selling season. Accounts receivable increase during the third and fourth quarter

as customers increase their purchases to meet expected consumer demand in the holiday season. Due to the

concentrated timeframe of this selling period, payments for these accounts receivable are generally not due

until the fourth quarter or early in the first quarter of the subsequent year. This timing difference between

expenditures and cash collections on accounts receivable makes it necessary for the Company to borrow

varying amounts during the year. During 2006, 2005 and 2004, the Company primarily utilized cash from

operations and its accounts receivable securitization program to fund its operations.

The Company is party to an accounts receivable securitization program, which was amended in December

2006, whereby the Company sells, on an ongoing basis, substantially all of its U.S. trade accounts receivable

to a bankruptcy remote special purpose entity, Hasbro Receivables Funding, LLC (“HRF”). HRF is

consolidated with the Company for financial reporting purposes. The securitization program then allows HRF

to sell, on a revolving basis, an undivided interest of up to $250,000 in the eligible receivables it holds to

29