Hasbro 2006 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2006 Hasbro annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.In addition to its focus on core brands, the Company’s strategy also involves trying to meet ever-changing

consumer preferences by identifying and offering innovative products based on market opportunities and

insights. The Company believes its strategy of focusing on the development of its core brands and continuing

to identify innovative new products will help to prevent the Company from being dependent on the success of

any one product line.

With the theatrical release of Lucasfilm’s STAR WARS EPISODE III: REVENGE OF THE SITH in

May 2005, and the subsequent holiday season DVD release, sales of product related to the Company’s

strategic STAR WARS license were a significant contributor to 2005 revenues and have continued to be strong

in 2006. Pairing this key licensed property with the Company’s ability to design and produce action figures,

role playing toys, and games, as well as its ability to launch an integrated marketing campaign to promote the

product globally, was the key to this line’s success. While sales of product related to this license performed

well in 2006, they were lower than 2005.

While the Company’s strategy has continued to focus on growing its core brands and developing

innovative, new products, it will continue to evaluate and enter into arrangements to license properties when

the Company believes it is economically attractive. In 2006, the Company entered into a license with Marvel

Entertainment, Inc. and Marvel Characters, Inc. (collectively “Marvel”) to produce toys and games based on

Marvel’s portfolio of characters. The Company will also incur royalties on products based on the theatrical

release of TRANSFORMERS in July 2007. While gross profits of theatrical entertainment-based products are

generally higher than many of the Company’s other products, sales from these products also incur royalty

expenses payable to the licensor. Such royalties reduce the impact of these higher gross margins. In certain

instances, such as with Lucasfilm’s STAR WARS, the Company may also incur amortization expense on

property right-based assets acquired from the licensor of such properties, further impacting profit made on

these products.

The Company remains committed to reducing fixed costs and increasing operating margins. Over the last

5 years the Company has improved its operating margin from 7.8% in 2002 to 11.9% in 2006. In the fourth

quarter of 2006, as part of its ongoing cost reduction efforts, the Company determined that it will reduce its

manufacturing activity in Ireland and transition the manufacture of certain products to the Company’s suppliers

in China. The Company is also investing to grow its business in emerging international markets. With a strong

balance sheet, and having achieved a debt to capitalization ratio of between 25-30%, the Company will also

continue to evaluate strategic alliances and acquisitions which may complement its current product offerings

or allow it entry into an area which is adjacent to and complementary to the toy and game business. The

Company expects to leverage revenue to offset the impact of these investments and maintain 2007 operating

margin levels near 2006.

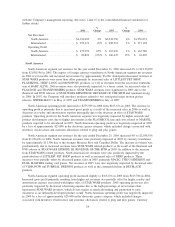

In recent years, the Company has been seeking to return excess cash to its shareholders through share

repurchase and dividends. As part of this initiative, in July 2006, the Company’s Board of Directors (the

“Board’’) authorized the repurchase of an additional $350,000 in common stock after a previous authorization

of $350,000 was exhausted in July 2006. For the fiscal year ended December 31, 2006, the Company has

invested $456,744 in the repurchase of 22,767 shares of common stock in the open market. The Company

intends to opportunistically repurchase shares in the future subject to market conditions. In addition, in

February 2007, the Company announced an increase in its quarterly dividend to $.16 per share. This is the

fourth consecutive year that the Board of Directors has increased the dividend rate.

22