Hasbro 2006 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2006 Hasbro annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

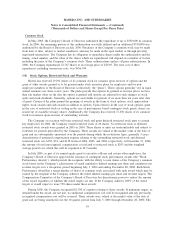

The Company measures its liabilities and related assets at September 30 (“the measurement date”) to

coincide with the upcoming year planning cycle. The discount rates used in the pension calculation were also

used for the postretirement calculation.

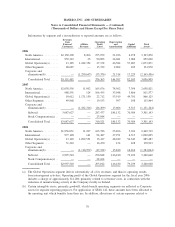

2006 2005 2004

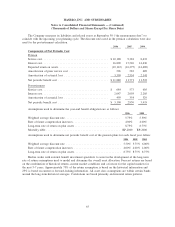

Components of Net Periodic Cost

Pension

Service cost.......................................... $10,188 9,384 8,632

Interest cost.......................................... 16,809 15,526 14,630

Expected return on assets ................................ (19,112) (16,275) (14,489)

Amortization of prior service cost ......................... 596 582 609

Amortization of actuarial loss ............................ 3,399 2,554 2,141

Net periodic benefit cost ................................ $11,880 11,771 11,523

Postretirement

Service cost.......................................... $ 684 573 605

Interest cost.......................................... 2,047 2,003 2,285

Amortization of actuarial loss ............................ 459 354 529

Net periodic benefit cost ................................ $ 3,190 2,930 3,419

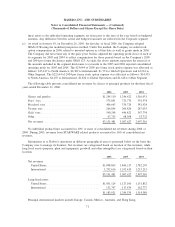

Assumptions used to determine the year-end benefit obligation are as follows:

2006 2005

Weighted average discount rate ................................... 5.75% 5.50%

Rate of future compensation increases .............................. 4.00% 4.00%

Long-term rate of return on plan assets ............................. 8.75% 8.75%

Mortality table . . . ............................................ RP-2000 RP-2000

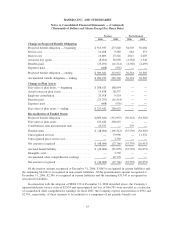

Assumptions used to determine net periodic benefit cost of the pension plans for each fiscal year follow:

2006 2005 2004

Weighted average discount rate ................................... 5.50% 5.75% 6.00%

Rate of future compensation increases .............................. 4.00% 4.00% 4.00%

Long-term rate of return on plan assets .............................. 8.75% 8.75% 8.75%

Hasbro works with external benefit investment specialists to assist in the development of the long-term

rate of return assumptions used to model and determine the overall asset allocation. Forecast returns are based

on the combination of historical returns, current market conditions and a forecast for the capital markets for

the next 5-7 years. Approximately 75% of the return assumption is based on the historical information and

25% is based on current or forward-looking information. All asset class assumptions are within certain bands

around the long-term historical averages. Correlations are based primarily on historical return patterns.

65

HASBRO, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements — (Continued)

(Thousands of Dollars and Shares Except Per Share Data)