Hasbro 2006 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2006 Hasbro annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

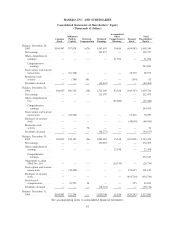

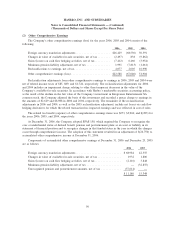

A summary of the Company’s other intangibles, net at December 31, 2006 and December 25, 2005 is as

follows:

2006 2005

Acquired product rights ....................................... $903,182 900,891

Licensed rights of entertainment properties ......................... 211,555 219,071

Accumulated amortization...................................... (658,218) (586,022)

Amortizable intangible assets . . ................................. 456,519 533,940

Product rights with indefinite lives ............................... 75,738 75,738

Unrecognized pension prior service cost ........................... — 3,755

$ 532,257 613,433

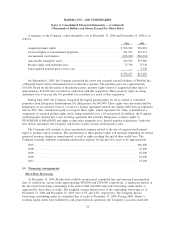

On September 9, 2005, the Company purchased the assets and assumed certain liabilities of Wrebbit Inc.,

a Montreal-based creator and manufacturer of innovative puzzles. The purchase price was approximately

$14,200. Based on the allocation of the purchase price, property rights related to acquired product lines of

approximately $10,900 were recorded in connection with this acquisition. These property rights are being

amortized over a ten year life. No goodwill was recorded as a result of this acquisition.

During June 2005, the Company reacquired the digital gaming rights for all its owned or controlled

properties from Infogrames Entertainment SA (Infogrames) for $65,000. These rights were previously held by

Infogrames on an exclusive basis as a result of a license agreement entered into during 2000 with an expiration

date in 2016. The consideration paid to reacquire these rights, which represents fair value, is included as a

component of acquired product rights and is being amortized over a 10-year period. In addition, the Company

and Infogrames entered into a new licensing agreement that provides Infogrames exclusive rights to

DUNGEONS & DRAGONS and rights to nine other properties for a limited number of platforms. Under the

new license agreement, the Company will receive royalty income on Infogrames sales.

The Company will continue to incur amortization expense related to the use of acquired and licensed

rights to produce various products. The amortization of these product rights will fluctuate depending on related

projected revenues during an annual period, as well as rights reaching the end of their useful lives. The

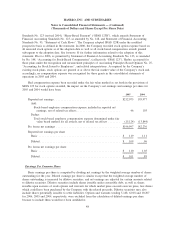

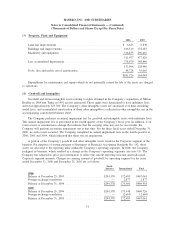

Company currently estimates continuing amortization expense for the next five years to be approximately:

2007 ................................................................ $66,400

2008 ................................................................ 67,400

2009 ................................................................ 62,500

2010 ................................................................ 36,000

2011 ................................................................ 34,200

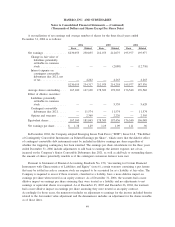

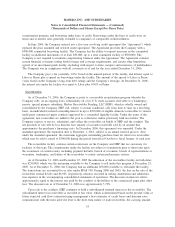

(5) Financing Arrangements

Short-Term Borrowings

At December 31, 2006, Hasbro had available an unsecured committed line and unsecured uncommitted

lines of credit from various banks approximating $300,000 and $203,600, respectively. A significant portion of

the short-term borrowings outstanding at the end of 2006 and 2005 represents borrowings made under, or

supported by, these lines of credit. The weighted average interest rates of the outstanding borrowings as of

December 31, 2006 and December 25, 2005 were 4.7% and 4.2%, respectively. The Company had no

borrowings outstanding under its committed line of credit at December 31, 2006. During 2006, Hasbro’s

working capital needs were fulfilled by cash generated from operations, the Company’s accounts receivable

52

HASBRO, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements — (Continued)

(Thousands of Dollars and Shares Except Per Share Data)