Hasbro 2006 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2006 Hasbro annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Stock-Based Compensation

The Company has a stock-based compensation plan for employees and non-employee members of the

Company’s Board of Directors. Under this plan, the Company grants stock options at or above the fair market

value of the Company’s stock. On December 26, 2005, the first day of fiscal 2006, the Company adopted

SFAS 123R, which requires the Company to measure all stock-based compensation awards using a fair value

method and record such expense in its consolidated financial statements. The Company uses the Black-Scholes

option pricing model to value the stock options that are granted under these plans. The Black-Scholes method

includes four significant assumptions: (1) expected term of the options, (2) risk-free interest rate, (3) expected

dividend yield, and (4) expected stock price volatility. For the Company’s 2006 stock option grant, the

weighted average expected term was approximately 5 years. This amount is based on a review of employees’

exercise history relating to stock options as well as the contractual term of the option. The weighted average

risk-free interest rate used for 2006 stock option grants was 4.98%. This estimate was based on the interest

rate available on U.S. treasury securities with durations that approximate the expected term of the option. For

2006 stock option grants, the weighted average expected dividend yield used was 2.55% which is based on the

Company’s current annual dividend amount divided by the stock price on the date of the grant. The weighted

average expected stock price volatility used for 2006 stock option grants was 24%. This amount was derived

using a combination of historical price volatility over the most recent period approximating the expected term

of the option and implied price volatility. Implied price volatility represents the volatility implied in publicly

traded options on the Company’s stock, which the Company believes represents the expected future volatility

of the Company’s stock price. The Company believes that since this is a market-based estimate, it can provide

a better estimate of expected future volatility.

In July 2006, as part of its employee stock-based compensation plan, the Company issued contingent

stock performance awards, which provide the recipients with the ability to earn shares of the Company’s

common stock based on the Company’s achievement of stated cumulative diluted earnings per share and

cumulative net revenue targets over a ten quarter period beginning July 3, 2006 and ending December 28,

2008. Each award has a target number of shares of common stock associated with such award which may be

earned by the recipient if the Company achieves the stated diluted earnings per share and net revenue targets.

The measurement of the expense related to this award is based on the Company’s current estimate of revenues

and diluted earnings per share over the performance period. Changes in these estimates may impact the

expense recognized related to these awards.

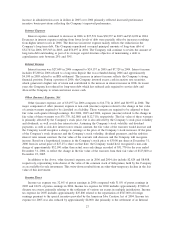

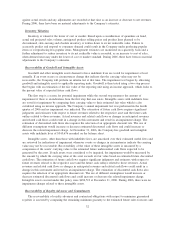

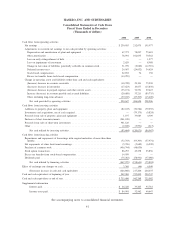

Contractual Obligations and Commercial Commitments

In the normal course of its business, the Company enters into contracts related to obtaining rights to

produce product under license, which may require the payment of minimum guarantees, as well as contracts

related to the leasing of facilities and equipment. In addition, the Company has $494,983 in principal amount

of long-term debt outstanding at December 31, 2006, excluding fair value adjustments. Future payments

required under these and other obligations as of December 31, 2006 are as follows:

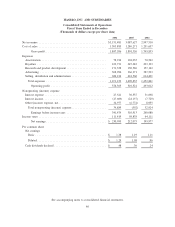

Certain Contractual Obligations 2007 2008 2009 2010 2011 Thereafter Total

Payments Due by Fiscal Year

Long-term debt ................. $ — 135,092 — — — 359,891 494,983

Interest payments on long-term

debt ....................... 22,436 22,436 14,128 14,128 14,128 192,058 279,314

Operating lease commitments . ..... 28,149 25,529 21,733 10,979 10,487 22,914 119,791

Future minimum guaranteed

contractual payments ........... 91,890 12,380 13,900 41,810 4,800 — 164,780

Purchase commitments ........... 249,554 — — — — — 249,554

$392,029 195,437 49,761 66,917 29,415 574,863 1,308,422

The Company’s agreement with MARVEL also requires the Company to make minimum expenditures on

marketing and promotional activities, including the spending of at least $15,000 associated with the motion

34