Hasbro 2006 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2006 Hasbro annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

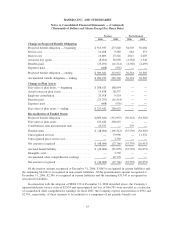

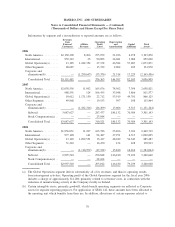

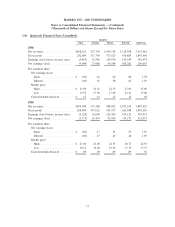

2006 2005 2006 2005

Pension Postretirement

Change in Projected Benefit Obligation

Projected benefit obligation — beginning .......... $313,937 277,820 38,505 36,082

Service cost ............................... 10,188 9,383 684 573

Interest cost ............................... 16,809 15,526 2,047 2,003

Actuarial loss (gain) ......................... (8,014) 28,698 (2,358) 2,342

Benefits paid ............................... (23,291) (16,514) (2,560) (2,495)

Expenses paid .............................. (608) (976) — —

Projected benefit obligation — ending ............ $309,021 313,937 36,318 38,505

Accumulated benefit obligation — ending ......... $290,452 289,720 36,318 38,505

Change in Plan Assets

Fair value of plan assets — beginning ............ $208,625 188,054 — —

Actual return on plan assets .................... 14,838 28,537 — —

Employer contribution ........................ 35,918 9,524 — —

Benefits paid ............................... (23,291) (16,514) — —

Expenses paid .............................. (608) (976) — —

Fair value of plan assets — ending ............... $235,482 208,625 — —

Reconciliation of Funded Status

Projected benefit obligation .................... $(309,021) (313,937) (36,318) (38,505)

Fair value of plan assets ...................... 235,482 208,625 — —

Contributions after measurement date............. 25,533 — 579 —

Funded status .............................. $ (48,006) (105,312) (35,739) (38,505)

Unrecognized net loss ........................ — 73,996 — 11,552

Unrecognized prior service cost ................. — 3,550 — —

Net amount recognized ....................... $ (48,006) (27,766) (35,739) (26,953)

Accrued benefit liability ...................... $ (48,006) (81,095) (35,739) (26,953)

Intangible asset ............................. — 3,550 — —

Accumulated other comprehensive earnings ........ — 49,779 — —

Net amount recognized ....................... $ (48,006) (27,766) (35,739) (26,953)

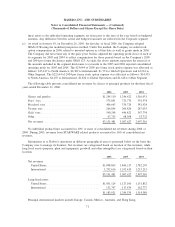

Of the pension amount recognized at December 31, 2006, $3,065 is recognized in current liabilities and

the remaining $44,941 is recognized in non-current liabilities. Of the postretirement amount recognized at

December 31, 2006, $2,396 is recognized in current liabilities and the remaining $33,343 is recognized in

non-current liabilities.

In connection with the adoption of SFAS 158 at December 31, 2006 described above, the Company’s

unamortized prior service costs of $2,954 and unrecognized net loss of $66,781 were recorded as a reduction

of accumulated other comprehensive earnings. In fiscal 2007, the Company expects amortization of $592 and

$2,914, respectively, of these amounts to be included as a component of net periodic benefit cost.

63

HASBRO, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements — (Continued)

(Thousands of Dollars and Shares Except Per Share Data)