Hasbro 2006 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2006 Hasbro annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Recoverability is measured by a comparison of the carrying amount of an asset to future undiscounted net

cash flows expected to be generated by the asset. If such assets were considered to be impaired, the

impairment to be recognized would be measured by the amount by which the carrying value of the assets

exceeds their fair value. Fair value is determined based on discounted cash flows or appraised values,

depending on the nature of the asset. Assets to be disposed of are carried at the lower of the net book value or

their fair value less disposal costs.

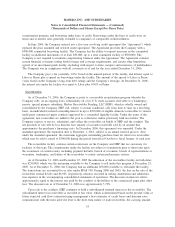

Financial Instruments

Hasbro’s financial instruments include cash and cash equivalents, accounts receivable, marketable

securities, short- and long-term borrowings, accounts payable and accrued liabilities. At December 31, 2006,

the carrying cost of these instruments approximated their fair value, with the exception of the Company’s

contingent convertible debentures due 2021. At December 31, 2006, these debentures had a carrying value of

$249,996 and an approximate fair value of $318,700. The Company’s financial instruments also include

foreign currency forwards (see note 13) as well as interest rate swap agreements (see note 7). At December 31,

2006, the carrying value of these instruments approximated their fair value based on quoted or publicly

available market information.

Securitization and Transfer of Financial Instruments

Hasbro has an agreement that allows the Company to sell, on an ongoing basis, an undivided interest in

certain of its trade accounts receivable through a revolving securitization arrangement. The Company retains

servicing responsibilities for, as well as a subordinate interest in the transferred receivables. Hasbro accounts

for the securitization of trade accounts receivable as a sale in accordance with SFAS No. 140, “Accounting for

Transfers and Servicing of Financial Assets and Extinguishment of Liabilities” (“SFAS 140”). As a result, the

related receivables are removed from the consolidated balance sheet.

Revenue Recognition

Revenue from product sales is recognized upon the passing of title to the customer, generally at the time

of shipment. Provisions for discounts, rebates and returns are made when the related revenues are recognized.

The Company bases its estimates for discounts, rebates and returns on agreed customer terms and historical

experience.

The Company enters into arrangements licensing its brand names on specifically approved products. The

licensees pay the Company royalties as products are sold, in some cases subject to annual minimum

guaranteed amounts. Royalty revenues are recognized as they are reported as earned and payment becomes

assured, over the life of the agreement. Revenue from product sales less related provisions for discounts,

rebates and returns, as well as royalty revenues comprise net revenues in the consolidated statements of

operations.

Royalties

The Company enters into license agreements with inventors, designers and others for the use of

intellectual properties in its products. These agreements may call for payment in advance or future payment

for minimum guaranteed amounts. Amounts paid in advance are recorded as an asset and charged to expense

as revenue from the related products is recognized. If all or a portion of the minimum guaranteed amounts

appear not to be recoverable through future use of the rights obtained under license, the nonrecoverable

portion of the guaranty is charged to expense at that time.

45

HASBRO, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements — (Continued)

(Thousands of Dollars and Shares Except Per Share Data)