Hasbro 2006 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2006 Hasbro annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

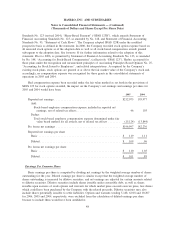

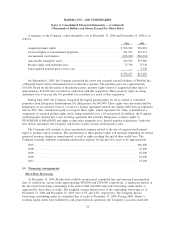

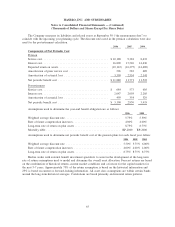

Hasbro has a valuation allowance for deferred tax assets at December 31, 2006 of $27,808, which is an

increase of $4,475 from $23,333 at December 25, 2005. The valuation allowance pertains to United States and

International loss carryforwards, some of which have no expiration and others that would expire beginning in

2007. The increase in the valuation allowance is primarily attributable to the investment in Infogrames

Entertainment S.A. If the operating loss carryforwards are fully realized, $210 will reduce goodwill and the

balance will reduce future income tax expense.

Based on Hasbro’s history of taxable income and the anticipation of sufficient taxable income in years

when the temporary differences are expected to become tax deductions, it believes that it will realize the

benefit of the deferred tax assets, net of the existing valuation allowance.

Deferred income taxes of $83,854 and $103,209 at the end of 2006 and 2005, respectively, are included

as a component of prepaid expenses and other current assets, and $66,276 and $58,075, respectively, are

included as a component of other assets. At the same dates, deferred income taxes of $122 and $200,

respectively, are included as a component of accrued liabilities, and $1,839 and $1,630, respectively, are

included as a component of other liabilities.

The cumulative amount of undistributed earnings of Hasbro’s international subsidiaries held for reinvest-

ment is approximately $625,000 at December 31, 2006. In the event that all international undistributed

earnings were remitted to the United States, the amount of incremental taxes would be approximately

$135,000.

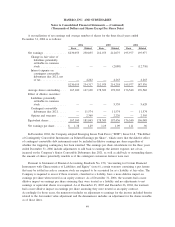

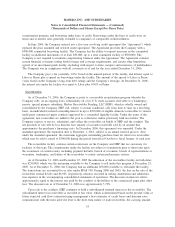

In June of 2006, the FASB issued FASB Interpretation No. 48, “Accounting for Uncertainty in Income

Taxes” (“FIN 48”), which applies to all tax positions accounted for under Statement of Financial Accounting

Standard No. 109, “Accounting for Income Taxes”. FIN 48 prescribes a two step process for the measurement

of uncertain tax positions that have been taken or are expected to be taken in a tax return. The first step is a

determination of whether the tax position should be recognized in the financial statements. The second step

determines the measurement of the tax position. FIN 48 also provides guidance on derecognition of such tax

positions, classification, interest and penalties, accounting in interim periods and disclosure. FIN 48 was

applicable to the Company as of January 1, 2007, the first day of fiscal 2007. The adoption of FIN 48 is

expected to decrease the Company’s current liabilities and increase the Company’s long-term liabilities.

Overall, tax liabilities are not expected to change by a material amount.

(9) Capital Stock

Preference Share Purchase Rights

Hasbro maintains a Preference Share Purchase Rights Plan (the “Rights Plan”). Under the terms of the

Rights Plan, each share of common stock is accompanied by a Preference Share Purchase Right (“Right”).

Each Right is only exercisable under certain circumstances and, until exercisable, the Rights are not

transferable apart from Hasbro’s common stock. When exercisable, each Right will entitle its holder to

purchase until June 30, 2009, in certain merger or other business combination or recapitalization transactions,

at the Right’s then current exercise price, a number of the acquiring company’s or Hasbro’s, as the case may

be, common shares having a market value at that time of twice the Right’s exercise price. Under certain

circumstances, the Company may substitute cash, other assets, equity securities or debt securities for the

common stock. At the option of the Board of Directors of Hasbro (“the Board”), the rightholder may, under

certain circumstances, receive shares of Hasbro’s stock in exchange for Rights.

Prior to the acquisition by a person or group of beneficial ownership of a certain percentage of Hasbro’s

common stock, the Rights are redeemable for $.01 per Right. The Rights Plan contains certain exceptions with

respect to the Hassenfeld family and related entities.

58

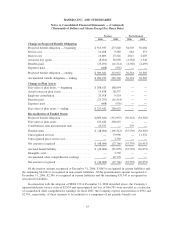

HASBRO, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements — (Continued)

(Thousands of Dollars and Shares Except Per Share Data)