GameStop 2009 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2009 GameStop annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

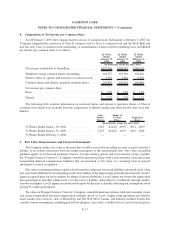

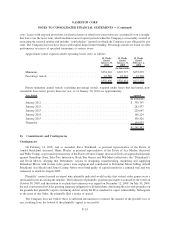

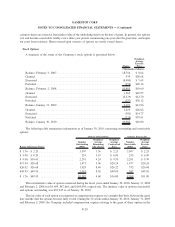

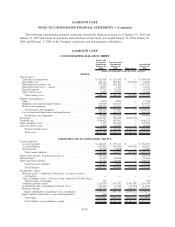

The difference in income tax provided and the amounts determined by applying the statutory rate to income

before income taxes resulted from the following:

52 Weeks

Ended

January 30,

2010

52 Weeks

Ended

January 31,

2009

52 Weeks

Ended

February 2,

2008

Federal statutory tax rate ........................... 35.0% 35.0% 35.0%

State income taxes, net of federal effect ................ 1.5 1.1 0.5

Foreign income taxes .............................. 1.5 0.5 (0.8)

Other (including permanent differences) ................ (1.8) 0.6 (0.1)

36.2% 37.2% 34.6%

The Company’s effective tax rate decreased from 37.2% in the 52 weeks ended January 31, 2009 to 36.2% in

the 52 weeks ended January 30, 2010, primarily due to audit settlements and statute expirations. The Company’s

effective tax rate increased from 34.6% in the 52 weeks ended February 2, 2008 to 37.2% in the 52 weeks ended

January 31, 2009, primarily due to expenses related to the mergers and acquisitions and associated corporate

structuring. Valuation allowances on foreign net operating losses were released during fiscal 2007 upon such

subsidiaries attaining profitability.

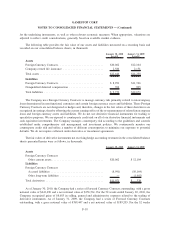

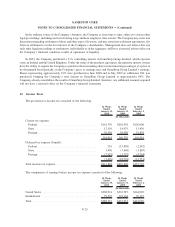

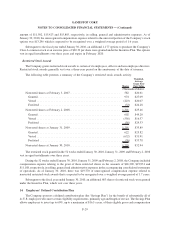

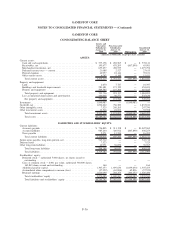

Differences between financial accounting principles and tax laws cause differences between the bases of

certain assets and liabilities for financial reporting purposes and tax purposes. The tax effects of these differences, to

the extent they are temporary, are recorded as deferred tax assets and liabilities and consisted of the following

components:

January 30,

2010

January 31,

2009

(In thousands)

Deferred tax asset:

Fixed assets ............................................. $ 29,785 $ 32,460

Inventory obsolescence reserve . .............................. 17,371 16,580

Deferred rents ............................................ 14,738 13,001

Stock-based compensation ................................... 22,652 27,081

Net operating losses ....................................... 12,250 15,283

Other .................................................. 9,979 13,565

Total deferred tax assets .................................. 106,775 117,970

Deferred tax liabilities:

Goodwill ............................................... (37,897) (34,033)

Prepaid expenses .......................................... (3,956) (4,392)

Acquired intangible assets ................................... (63,466) (60,576)

Valuation allowance ....................................... (2,037) —

Other .................................................. (3,656) (2,877)

Total deferred tax liabilities . . .............................. (111,012) (101,878)

Net.................................................. $ (4,237) $ 16,092

Financial statements:

Current deferred tax assets .................................... $ 21,229 $ 23,615

Deferred tax liabilities ....................................... $ (25,466) $ (7,523)

F-26

GAMESTOP CORP.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)