GameStop 2009 Annual Report Download - page 78

Download and view the complete annual report

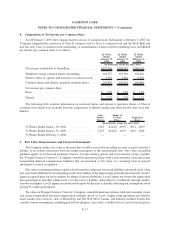

Please find page 78 of the 2009 GameStop annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.recognized in the amount of the excess. The Company completed its annual impairment test of goodwill on the first

day of the fourth quarter of fiscal 2007, fiscal 2008 and fiscal 2009 and concluded that none of its goodwill was

impaired. Note 8 provides additional information concerning the changes in goodwill for the consolidated financial

statements presented.

Other Intangible Assets

Other intangible assets consist primarily of tradenames, leasehold rights and amounts attributed to favorable

leasehold interests recorded as a result of business acquisitions. Intangible assets are recorded apart from goodwill if

they arise from a contractual right and are capable of being separated from the entity and sold, transferred, licensed,

rented or exchanged individually. The useful life and amortization methodology of intangible assets are determined

based on the period in which they are expected to contribute directly to cash flows. Intangible assets that are

determined to have a definite life are amortized over that period. Intangible assets that are determined to have an

indefinite life are not amortized, but are required to be evaluated at least annually for impairment. If the carrying

value of an individual indefinite-life intangible asset exceeds its fair value as determined by its discounted cash

flows, such individual indefinite-life intangible asset is written down by the amount of the excess. The Company

completed its annual impairment tests of indefinite-life intangible assets as of the first day of the fourth quarter of

fiscal 2007, fiscal 2008 and fiscal 2009 and concluded that none of its intangible assets were impaired.

Tradenames which were recorded as a result of the Micromania acquisition are considered indefinite life

intangible assets as they are expected to contribute to cash flows indefinitely and are not subject to amortization, but

are subject to annual impairment testing. Leasehold rights which were recorded as a result of the Micromania

acquisition represent the value of rights of tenancy under commercial property leases for properties located in

France. Rights pertaining to individual leases can be sold by us to a new tenant or recovered by us from the landlord

if the exercise of the automatic right of renewal is refused. Leasehold rights are amortized on a straight-line basis

over the expected lease term not to exceed 20 years with no residual value. Favorable leasehold interests represent

the value of the contractual monthly rental payments that are less than the current market rent at stores acquired as

part of the Micromania acquisition or the EB merger. Favorable leasehold interests are amortized on a straight-line

basis over their remaining lease term with no expected residual value. Note 8 provides additional information

related to the Company’s intangible assets.

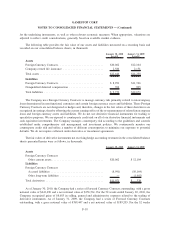

Revenue Recognition

Revenue from the sales of the Company’s products is recognized at the time of sale and is stated net of sales

discounts. The sales of used video game products are recorded at the retail price charged to the customer. Sales

returns (which are not significant) are recognized at the time returns are made. Subscription and advertising

revenues are recorded upon release of magazines for sale to consumers. Magazine subscription revenue is

recognized on a straight-line basis over the subscription period. Revenue from the sales of product replacement

plans is recognized on a straight-line basis over the coverage period. The deferred revenues for magazine

subscriptions and deferred financing plans are included in accrued liabilities (see Note 7).

Revenues do not include sales taxes or other taxes collected from customers.

Cost of Sales and Selling, General and Administrative Expenses Classification

The classification of cost of sales and selling, general and administrative expenses varies across the retail

industry. The Company includes purchasing, receiving and distribution costs in selling, general and administrative

expenses, rather than cost of goods sold, in the statement of operations. For the 52 weeks ended January 30, 2010,

January 31, 2009 and February 2, 2008, these purchasing, receiving and distribution costs amounted to $63,589,

$57,037 and $43,928, respectively.

F-10

GAMESTOP CORP.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)