GameStop 2009 Annual Report Download - page 22

Download and view the complete annual report

Please find page 22 of the 2009 GameStop annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

enhance our market leadership position in the video game industry and in the digital aggregation and distribution

category.

Operating Segments

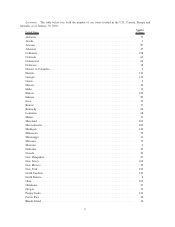

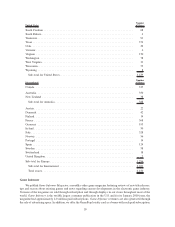

We identified our four operating segments based on a combination of geographic areas, the methods with

which we analyze performance and how we divide management responsibility. Segment results for the United States

include retail operations in the 50 states, the District of Columbia, Guam and Puerto Rico, the electronic commerce

Web site www.gamestop.com and Game Informer Magazine. Segment results for Canada include retail and

e-commerce operations in stores throughout Canada and segment results for Australia include retail and e-com-

merce operations in Australia and New Zealand. Segment results for Europe include retail and e-commerce

operations in 13 European countries.

Our U.S. segment is supported by distribution centers in Texas and Kentucky, and further supported by the use

of third-party distribution centers for new release titles. We distribute merchandise to our Canadian segment from

distribution centers in Ontario. We have a distribution center near Brisbane, Australia which supports our Australian

operations and a small distribution facility in New Zealand which supports the stores in New Zealand. European

segment operations are supported by six regionally-located distribution centers.

All of our segments purchase products from many of the same vendors, including Sony Corporation (“Sony”)

and Electronic Arts. Products from certain other vendors such as Microsoft and Nintendo are obtained either

directly from the manufacturer or publisher or through distributors depending upon the particular market in which

we operate.

Additional information, including financial information, regarding our operating segments can be found in

“Management’s Discussion and Analysis of Financial Condition and Results of Operations” elsewhere in this

Annual Report on Form 10-K and in Note 17 of “Notes to Consolidated Financial Statements.”

Merchandise

Substantially all of our revenues are derived from the sale of tangible products. Our product offerings consist of

new and used video game products, PC entertainment software, and related products, such as trading cards and

strategy guides. Our in-store inventory generally consists of a constantly changing selection of over 4,500 SKUs.

We have buying groups in each of our segments that negotiate terms, discounts and cooperative advertising

allowances for the stores in their respective geographic areas. We use customer requests and feedback, advance

orders, industry magazines and product reviews to determine which new releases are expected to be hits. Advance

orders are tracked at individual stores to distribute titles and capture demand effectively. This merchandise

management is essential because a significant portion of a game’s sales are usually generated in the first days and

weeks following its release.

Video Game Hardware. We offer the video game platforms of all major manufacturers, including the Sony

PlayStation 2 and 3 and PSP, Microsoft Xbox 360, the Nintendo Wii and DSi. We also offer extended service

agreements on video game hardware and software. In support of our strategy to be the destination location for

electronic game players, we aggressively promote the sale of video game platforms. Video game hardware sales are

generally driven by the introduction of new platform technology and the reduction in price points as platforms

mature. Due to our strong relationships with the manufacturers of these platforms, we often receive dispropor-

tionately large allocations of new release hardware products, which is an important component of our strategy to be

the destination of choice for electronic game players. We believe that selling video game hardware increases store

traffic and promotes customer loyalty, leading to increased sales of video game software and accessories, which

have higher gross margins than video game hardware.

Video Game Software. We purchase new video game software from the leading manufacturers, including

Sony, Nintendo and Microsoft, as well as over 40 third-party game publishers, such as Electronic Arts and

Activision. We are one of the largest customers of video game titles sold by these publishers. We generally carry

over 1,000 SKUs of new video game software at any given time across a variety of genres, including Sports, Action,

Strategy, Adventure/Role Playing and Simulation.

7