GameStop 2009 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2009 GameStop annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

In the ordinary course of the Company’s business, the Company is, from time to time, subject to various other

legal proceedings, including matters involving wage and hour employee class actions. The Company may enter into

discussions regarding settlement of these and other types of lawsuits, and may enter into settlement agreements, if it

believes settlement is in the best interest of the Company’s shareholders. Management does not believe that any

such other legal proceedings or settlements, individually or in the aggregate, will have a material adverse effect on

the Company’s financial condition, results of operations or liquidity.

In 2003, the Company purchased a 51% controlling interest in GameStop Group Limited, which operates

stores in Ireland and the United Kingdom. Under the terms of the purchase agreement, the minority interest owners

have the ability to require the Company to purchase their remaining shares in incremental percentages at a price to

be determined based partially on the Company’s price to earnings ratio and GameStop Group Limited’s earnings.

Shares representing approximately 16% were purchased in June 2008 and in July 2009 an additional 16% was

purchased, bringing the Company’s total interest in GameStop Group Limited to approximately 84%. The

Company already consolidates the results of GameStop Group Limited; therefore, any additional amounts acquired

will not have a material effect on the Company’s financial statements.

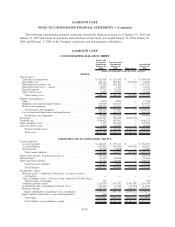

12. Income Taxes

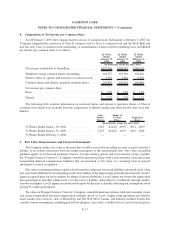

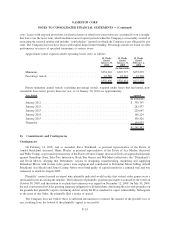

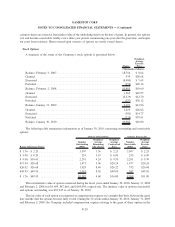

The provision for income tax consisted of the following:

52 Weeks

Ended

January 30,

2010

52 Weeks

Ended

January 31,

2009

52 Weeks

Ended

February 2,

2008

(In thousands)

Current tax expense:

Federal ....................................... $162,339 $201,438 $120,606

State......................................... 12,119 18,933 13,436

Foreign....................................... 39,556 39,999 31,874

214,014 260,370 165,916

Deferred tax expense (benefit):

Federal ....................................... 219 (15,858) (2,582)

State......................................... 1,496 (7,468) (1,805)

Foreign....................................... (2,925) (1,375) (8,764)

(1,210) (24,701) (13,151)

Total income tax expense ........................... $212,804 $235,669 $152,765

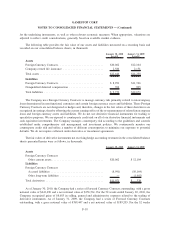

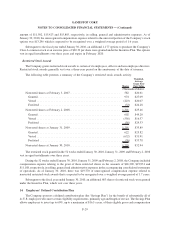

The components of earnings before income tax expense consisted of the following:

52 Weeks

Ended

January 30,

2010

52 Weeks

Ended

January 31,

2009

52 Weeks

Ended

February 2,

2008

(In thousands)

United States .................................... $508,961 $532,787 $364,929

International ..................................... 79,572 101,164 76,127

Total .......................................... $588,533 $633,951 $441,056

F-25

GAMESTOP CORP.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)