GameStop 2009 Annual Report Download - page 82

Download and view the complete annual report

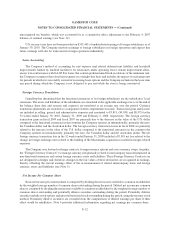

Please find page 82 of the 2009 GameStop annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.New Accounting Pronouncements

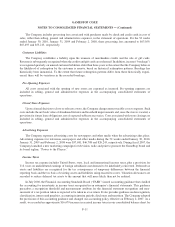

In March 2008, the FASB amended existing disclosure requirements related to derivative and hedging

activities, which became effective for the Company on February 1, 2009 and is being applied prospectively. As a

result of the amended disclosure requirements, the Company is required to provide expanded qualitative and

quantitative disclosures about derivatives and hedging activities in each interim and annual period. The adoption of

the new disclosure requirements had no impact on our consolidated financial statements.

In December 2007, the FASB amended its guidance on accounting for business combinations. The new

accounting guidance amends the principles and requirements for how an acquirer recognizes and measures in its

financial statements the identifiable assets acquired, the liabilities assumed, any noncontrolling interest in the

acquiree and the goodwill acquired. It also establishes disclosure requirements to enable the evaluation of the nature

and financial effects of the business combination. The new accounting guidance resulted in a change in our

accounting policy effective February 1, 2009, and is being applied prospectively to all business combinations

subsequent to the effective date. The adoption of this new accounting policy did not have a significant impact on our

consolidated financial statements and the impact that its adoption will have on our consolidated financial statements

in future periods will depend on the nature and size of business combinations completed subsequent to the date of

adoption.

In December 2007, the FASB issued new accounting and disclosure guidance related to noncontrolling

interests in subsidiaries (previously referred to as minority interests), which resulted in a change to our accounting

policy effective February 1, 2009. The new guidance requires all entities to report noncontrolling interests in

subsidiaries as a component of equity in the consolidated financial statements and also establishes disclosure

requirements that clearly identify and distinguish between controlling and noncontrolling interests and requires the

separate disclosure of income attributable to controlling and noncontrolling interests. The new accounting guidance

is being applied prospectively. The adoption of this new accounting policy did not have a significant impact on our

consolidated financial statements.

In September 2006, the FASB issued new accounting guidance which defines fair value, establishes a

framework for measuring fair value and expands disclosure requirements about fair value measurements. However,

in February 2008, the FASB delayed the effective date of the new accounting guidance for all nonfinancial assets

and nonfinancial liabilities, except those that are recognized or disclosed at fair value in the financial statements on

a recurring basis (at least annually). The adoption of this new accounting guidance for our nonfinancial assets and

nonfinancial liabilities on February 1, 2009 did not have a significant impact on our consolidated financial

statements.

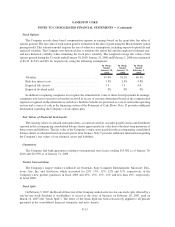

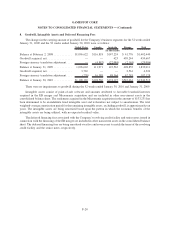

2. Acquisitions

On November 17, 2008, GameStop France SAS, a wholly-owned subsidiary of the Company, completed the

acquisition of substantially all of the outstanding capital stock of Micromania for $580,407, net of cash acquired.

Micromania is a leading retailer of video and computer games in France with 368 locations, 328 of which were

operating upon acquisition. The Company funded the transaction with cash on hand, funds drawn against its

existing $400,000 credit agreement (the “Revolver”) totaling $275,000, and term loans totaling $150,000 under a

junior term loan facility (the “Term Loans”). As of January 31, 2009, all of the borrowings against the Revolver and

the Term Loans have been repaid. The purpose of the acquisition was to expand the Company’s presence in Europe.

The impact of the acquisition on the Company’s results of operations, as if the acquisition had been completed as of

the beginning of the periods presented, is not significant.

F-14

GAMESTOP CORP.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)