GameStop 2009 Annual Report Download - page 79

Download and view the complete annual report

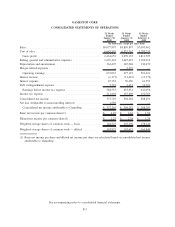

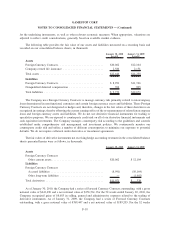

Please find page 79 of the 2009 GameStop annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.The Company includes processing fees associated with purchases made by check and credit cards in cost of

sales, rather than selling, general and administrative expenses, in the statement of operations. For the 52 weeks

ended January 30, 2010, January 31, 2009 and February 2, 2008, these processing fees amounted to $63,059,

$65,493 and $55,215, respectively.

Customer Liabilities

The Company establishes a liability upon the issuance of merchandise credits and the sale of gift cards.

Revenue is subsequently recognized when the credits and gift cards are redeemed. In addition, income (“breakage”)

is recognized quarterly on unused customer liabilities older than three years to the extent that the Company believes

the likelihood of redemption by the customer is remote, based on historical redemption patterns. Breakage has

historically been immaterial. To the extent that future redemption patterns differ from those historically experi-

enced, there will be variations in the recorded breakage.

Pre-Opening Expenses

All costs associated with the opening of new stores are expensed as incurred. Pre-opening expenses are

included in selling, general and administrative expenses in the accompanying consolidated statements of

operations.

Closed Store Expenses

Upon a formal decision to close or relocate a store, the Company charges unrecoverable costs to expense. Such

costs include the net book value of abandoned fixtures and leasehold improvements and, once the store is vacated, a

provision for future lease obligations, net of expected sublease recoveries. Costs associated with store closings are

included in selling, general and administrative expenses in the accompanying consolidated statements of

operations.

Advertising Expenses

The Company expenses advertising costs for newspapers and other media when the advertising takes place.

Advertising expenses for television, newspapers and other media during the 52 weeks ended January 30, 2010,

January 31, 2009 and February 2, 2008 were $57,681, $46,708 and $26,243, respectively. During fiscal 2007, the

Company launched a new marketing campaign for television, radio and print to promote the GameStop brand and

its brand tagline, “Power to the Players.”

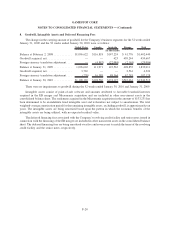

Income Taxes

Income tax expense includes United States, state, local and international income taxes, plus a provision for

U.S. taxes on undistributed earnings of foreign subsidiaries not deemed to be indefinitely reinvested. Deferred tax

assets and liabilities are recognized for the tax consequences of temporary differences between the financial

reporting basis and the tax basis of existing assets and liabilities using enacted tax rates. Valuation allowances are

recorded to reduce deferred tax assets to the amount that will more likely than not be realized.

In July 2006, the Financial Accounting Standards Board (“FASB”) issued accounting guidance that clarified

the accounting for uncertainty in income taxes recognized in an enterprise’s financial statements. This guidance

prescribes a recognition threshold and measurement attribute for the financial statement recognition and mea-

surement of a tax position taken or expected to be taken in a tax return. It also provides guidance on derecognition,

classification, interest and penalties, accounting in interim periods, disclosure and transition. The Company adopted

the provisions of this accounting guidance and changed our accounting policy effective on February 4, 2007. As a

result, we recorded an approximate $16,679 increase in accrued income taxes in our consolidated balance sheet for

F-11

GAMESTOP CORP.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)