GameStop 2009 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2009 GameStop annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ended January 31, 2009, the Company recognized gains of $5,494 in selling, general and administrative expenses

related to the trading of derivative instruments.

The Company’s carrying value of financial instruments approximates their fair value, except for differences

with respect to the senior notes. The fair value of the Company’s senior notes payable in the accompanying

consolidated balance sheets is estimated based on recent quotes from brokers. As of January 30, 2010, the senior

notes payable had a carrying value of $447,343 and a fair value of $465,975. As of January 31, 2009, the senior

notes payable had a carrying value of $545,712 and a fair value of $547,250.

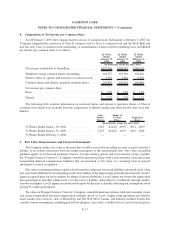

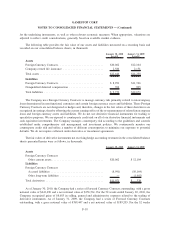

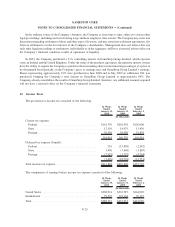

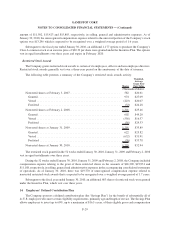

6. Receivables, Net

Receivables consist primarily of bankcard receivables and other receivables. Other receivables include

receivables from Game Informer Magazine advertising customers, receivables from landlords for tenant allowances

and receivables from vendors for merchandise returns, vendor marketing allowances and various other programs.

An allowance for doubtful accounts has been recorded to reduce receivables to an amount expected to be collectible.

Receivables consisted of the following:

January 30,

2010

January 31,

2009

(In thousands)

Bankcard receivables ........................................ $51,460 $45,650

Other receivables ........................................... 15,931 24,097

Allowance for doubtful accounts . . .............................. (3,385) (3,766)

Total receivables, net ........................................ $64,006 $65,981

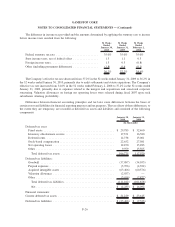

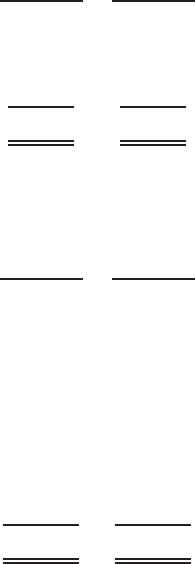

7. Accrued Liabilities

Accrued liabilities consisted of the following:

January 30,

2010

January 31,

2009

(In thousands)

Customer liabilities .......................................... $199,175 $163,904

Deferred revenue ........................................... 61,203 42,936

Accrued rent............................................... 18,690 20,760

Accrued interest ............................................ 15,862 18,416

Employee compensation and related taxes ......................... 89,771 83,475

Other taxes ................................................ 63,692 61,434

Settlement of treasury share purchases ............................ 64,615 —

Other accrued liabilities ...................................... 119,095 107,328

Total accrued liabilities ....................................... $632,103 $498,253

F-19

GAMESTOP CORP.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)