GameStop 2009 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2009 GameStop annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

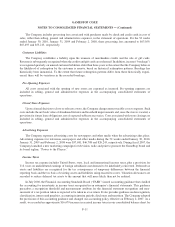

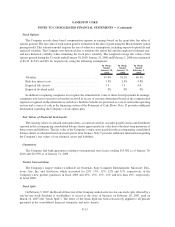

The consolidated financial statements include the results of Micromania from the date of acquisition and are

reported in the European segment. The purchase price has been allocated based on estimated fair values as of the

acquisition date. The purchase price was allocated as follows as of November 17, 2008:

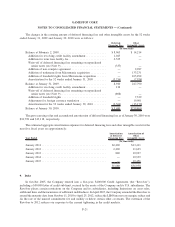

November 17,

2008

(In thousands)

Current assets ...................................................... $187,662

Property, plant & equipment............................................ 34,164

Goodwill .......................................................... 415,258

Intangible assets:

Tradename ....................................................... 131,560

Leasehold rights and interests . ........................................ 103,955

Total intangible assets ............................................. 235,515

Other long-term assets ................................................ 7,786

Current liabilities .................................................... (223,171)

Long-term liabilities ................................................. (76,807)

Total purchase price .................................................. $580,407

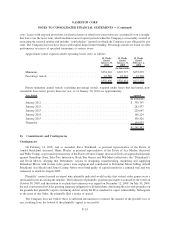

In determining the purchase price allocation, management considered, among other factors, the Company’s

intention to use the acquired assets. The total weighted-average amortization period for the intangible assets,

excluding goodwill and the Micromania tradename, is approximately ten years. The intangible assets are being

amortized based upon the pattern in which the economic benefits of the intangible assets are being utilized, with no

expected residual value. None of the goodwill is deductible for income tax purposes. Note 8 provides additional

information concerning goodwill and intangible assets.

Merger-related expenses totaling $4,593 shown in the fiscal 2008 statements of operations include a net loss

related to the change in foreign exchange rates related to the funding of the Micromania acquisition and other costs

considered to be of a one-time or short-term nature which are included in operating earnings.

The acquisition of Micromania is an important part of the Company’s European and overall growth strategy

and gives the Company an immediate entrance into the second largest video game market in Europe. The amount

the Company paid in excess of the fair value of the net assets acquired was primarily for (i) the expected future cash

flows derived from the existing business and its infrastructure, (ii) the geographical benefits from adding stores in a

new large, growing market without cannibalizing existing sales, (iii) expanding the Company’s expertise in the

European video game market as a whole, and (iv) increasing the Company’s impact on the European market,

including increasing the Company’s purchasing power.

On April 5, 2008, the Company purchased all the outstanding stock of Free Record Shop Norway AS, a

Norwegian private limited liability company (“FRS”), for $21,006, net of cash acquired. FRS operated 49 record

stores in Norway, nine of which have been closed as of January 31, 2009. The Company has converted the remaining

stores into video game stores with an inventory assortment similar to its other stores in Norway. The acquisition was

accounted for using the purchase method of accounting, with the excess of the purchase price over the net assets

acquired, in the amount of $17,981, recorded as goodwill. The Company has included the results of operations of

FRS, which were not material, in its financial statements beginning on the closing date of the acquisition on April 5,

2008.

In 2003, the Company purchased a 51% controlling interest in GameStop Group Limited, which operates

stores in Ireland and the United Kingdom. Under the terms of the purchase agreement, the minority interest owners

have the ability to require the Company to purchase their remaining shares in incremental percentages at a price to

F-15

GAMESTOP CORP.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)