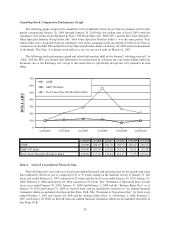

GameStop 2009 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2009 GameStop annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

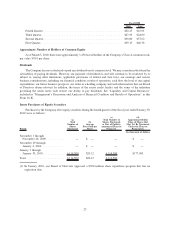

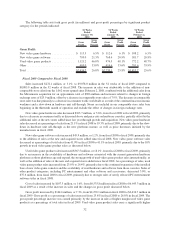

(1) Includes the results of operations of EB from October 9, 2005, the day after completion of the EB merger,

through January 28, 2006.

(2) On the first day of the 53 weeks ended February 3, 2007 (“fiscal 2006”), the Company adopted new accounting

guidance on share-based payments, which required companies to expense the estimated fair value of stock options

and similar equity instruments issued to employees in its financial statements. The implementation of the new

accounting guidance affects the comparability of amounts from fiscal periods before fiscal 2006. The amount of

stock-based compensation included was $37.8 million, $35.4 million, $26.9 million and $21.0 million for the

fiscal years 2009, 2008, 2007 and 2006, respectively.

(3) The Company’s results of operations for fiscal 2008, fiscal 2006 and the 52 weeks ended January 28, 2006

(“fiscal 2005”) include expenses believed to be of a one-time or short-term nature associated with the

Micromania acquisition (fiscal 2008) and the EB merger (fiscal 2006 and fiscal 2005), which included

$4.6 million, $6.8 million and $13.6 million, respectively, considered in operating earnings and $7.5 million

included in fiscal 2005 in interest expense. In fiscal 2008, the $4.6 million included $3.5 million related to

foreign currency losses on funds used to purchase Micromania. In fiscal 2006 and fiscal 2005, the $6.8 million

and $13.6 million, respectively, included $1.9 million and $9.0 million in charges associated with assets of the

Company considered to be impaired as a result of the EB merger and $4.9 million and $4.6 million, respectively,

in costs associated with integrating the operations of GameStop and EB. Costs related to the EB merger

included in interest expense in fiscal 2005 include a fee of $7.1 million for an unused bridge financing facility

which the Company obtained as financing insurance in connection with the EB merger.

(4) Weighted average shares outstanding and earnings per common share have been adjusted to reflect the

Conversion and the Stock Split.

(5) Stores are included in our comparable store sales base beginning in the 13th month of operation.

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations

The following discussion should be read in conjunction with the information contained in our consolidated

financial statements, including the notes thereto. Statements regarding future economic performance, manage-

ment’s plans and objectives, and any statements concerning assumptions related to the foregoing contained in

Management’s Discussion and Analysis of Financial Condition and Results of Operations constitute forward-

looking statements. Certain factors, which may cause actual results to vary materially from these forward-looking

statements, accompany such statements or appear elsewhere in this Form 10-K, including the factors disclosed

under “Item 1A. — Risk Factors.”

General

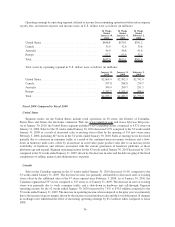

GameStop Corp. (together with its predecessor companies, “GameStop,” “we,” “us,” “our,” or the “Company”)

is the world’s largest retailer of video game products and PC entertainment software. We sell new and used video

game hardware, video game software and accessories, as well as PC entertainment software and other merchandise.

As of January 30, 2010, we operated 6,450 stores, in the United States, Australia, Canada and Europe, primarily

under the names GameStop and EB Games. We also operate electronic commerce Web sites under the names

www.gamestop.com, www.ebgames.com.au, www.gamestop.ca, www.gamestop.it, and www.micromania.fr and

publish Game Informer, the industry’s largest multi-platform video game magazine in the United States based on

circulation.

Our fiscal year is composed of 52 or 53 weeks ending on the Saturday closest to January 31. The fiscal years

ended January 30, 2010 (“fiscal 2009”), January 31, 2009 (“fiscal 2008”) and February 2, 2008 (“fiscal 2007”)

consisted of 52 weeks.

The Company began operations in November 1996. In October 1999, the Company was acquired by, and

became a wholly-owned subsidiary of, Barnes & Noble, Inc. (“Barnes & Noble”). In February 2002, GameStop

completed an initial public offering of its Class A common stock and was a majority-owned subsidiary of Barnes &

Noble until November 2004, when Barnes & Noble distributed its holdings of our common stock to its stockholders.

In October 2005, GameStop acquired the operations of Electronics Boutique Holdings Corp. (“EB”), a 2,300-store

26