GameStop 2009 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2009 GameStop annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Canada

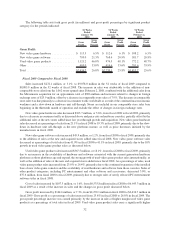

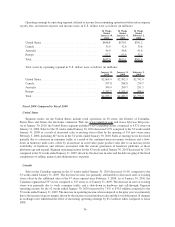

Sales in the Canadian segment in the 52 weeks ended January 31, 2009 increased 15.9% compared to the

52 weeks ended February 2, 2008. The increase in sales was primarily attributable to increased sales at existing

stores and the additional sales at the 58 stores opened since February 3, 2007. As of January 31, 2009, the Canadian

segment had 325 stores compared to 287 stores as of February 2, 2008. The increase in sales at existing stores was

driven by strong sales of new video game software related to the continued expansion of the installed base of new

hardware platforms. Segment operating income for the 52 weeks ended January 31, 2009 decreased by 8.9%

compared to the 52 weeks ended February 2, 2008. The decrease in operating income when compared to the prior

year was due primarily to a lower gross margin percentage driven by economic issues and competitive issues

stemming from changes in foreign exchange rates. For the 52 weeks ended January 31, 2009, changes in exchange

rates when compared to the prior year had the effect of decreasing operating earnings by $2.7 million.

Australia

As of January 31, 2009, the Australian segment included 350 stores, compared to 280 stores as of February 2,

2008. Sales for the 52 weeks ended January 31, 2009 increased 23.6% compared to the 52 weeks ended February 2,

2008. The increase in sales was due to higher sales at existing stores and the additional sales at the 133 stores opened

since February 3, 2007. The increase in sales at existing stores was due to a strong video game software title lineup

and the availability of the new hardware platforms in fiscal 2008 when compared to the prior fiscal year following

the launch of the Sony PlayStation 3 in the first quarter of fiscal 2007. In addition, the new hardware platforms drove

an increase in used product sales as the installed base of platforms increased and more software became available.

Segment operating income in the 52 weeks ended January 31, 2009 increased by 12.0% when compared to the

52 weeks ended February 2, 2008. The increase in operating earnings for the 52 weeks ended January 31, 2009 was

due to the higher sales and related gross margin offset by the higher selling, general and administrative expenses

associated with the increase in the number of stores in operation and the unfavorable impact of changes in exchange

rates since the prior year. For the 52 weeks ended January 31, 2009, changes in exchange rates when compared to

the prior year had the effect of decreasing operating earnings by $4.0 million.

Europe

As of January 31, 2009, the European segment operated 1,201 stores, compared to 636 stores as of February 2,

2008. For the 52 weeks ended January 31, 2009, European sales increased 66.9% compared to the 52 weeks ended

February 2, 2008. The increase in sales was primarily due to the additional sales at the 754 stores opened since

February 3, 2007, including the 328 stores from the Micromania acquisition and the 49 stores acquired from Free

Record Shop Norway AS, a Norwegian private limited liability company (“FRS”), in Norway during the first

quarter of fiscal 2008 and the increase in sales at existing stores. The increase in sales at existing stores was due to

strong sales of new video game software and the availability of the new hardware platforms in fiscal 2008 when

compared to the prior fiscal year following the launch of the Sony PlayStation 3 in the first quarter of fiscal 2007. In

addition, the new hardware platforms drove an increase in used product sales as the installed base of the platforms

increased and more software became available.

The segment operating income in Europe for the 52 weeks ended January 31, 2009 increased to $65.6 million

compared to $32.6 million in the 52 weeks ended February 2, 2008. The increase in the operating income was driven

by the increase in sales and related margin dollars discussed above, the earnings generated by the Micromania stores

and the continued maturation of our operations in the rest of the European market, offset by the unfavorable impact

of changes in exchange rates since the prior year. For the 52 weeks ended January 31, 2009, changes in exchange

rates when compared to fiscal 2007 had the effect of decreasing operating earnings by $3.3 million.

38