GameStop 2009 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2009 GameStop annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

for the underlying instruments, as well as other relevant economic measures. When appropriate, valuations are

adjusted to reflect credit considerations, generally based on available market evidence.

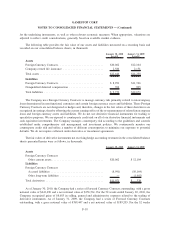

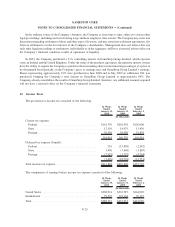

The following table provides the fair value of our assets and liabilities measured on a recurring basis and

recorded on our consolidated balance sheets, in thousands:

January 30, 2010

Level 2

January 31, 2009

Level 2

Assets

Foreign Currency Contracts ............................. $20,062 $12,104

Company-owned life insurance .......................... 2,584 2,134

Total assets ......................................... $22,646 $14,238

Liabilities

Foreign Currency Contracts ............................. $ 8,991 $11,766

Nonqualified deferred compensation ...................... 762 905

Total liabilities ...................................... $ 9,753 $12,671

The Company uses Foreign Currency Contracts to manage currency risk primarily related to intercompany

loans denominated in non-functional currencies and certain foreign currency assets and liabilities. These Foreign

Currency Contracts are not designated as hedges and, therefore, changes in the fair values of these derivatives are

recognized in earnings, thereby offsetting the current earnings effect of the re-measurement of related intercompany

loans and foreign currency assets and liabilities. We do not use derivative financial instruments for trading or

speculative purposes. We are exposed to counterparty credit risk on all of our derivative financial instruments and

cash equivalent investments. The Company manages counterparty risk according to the guidelines and controls

established under comprehensive risk management and investment policies. We continuously monitor our

counterparty credit risk and utilize a number of different counterparties to minimize our exposure to potential

defaults. We do not require collateral under derivative or investment agreements.

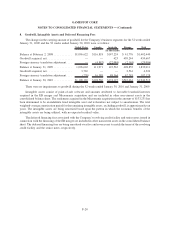

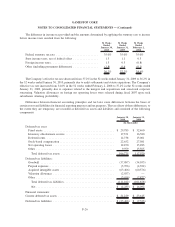

The fair values of derivative instruments not receiving hedge accounting treatment in the consolidated balance

sheets presented herein were as follows, in thousands:

January 30, 2010 January 31, 2009

Assets

Foreign Currency Contracts

Other current assets ................................. $20,062 $ 12,104

Liabilities

Foreign Currency Contracts

Accrued liabilities .................................. (8,991) (10,164)

Other long-term liabilities ............................ — (1,602)

Total derivatives ..................................... $11,071 $ 338

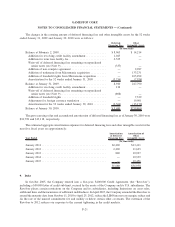

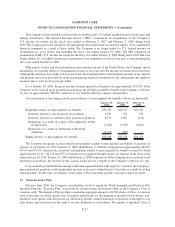

As of January 30, 2010, the Company had a series of Forward Currency Contracts outstanding, with a gross

notional value of $643,490 and a net notional value of $356,561. For the 52 weeks ended January 30, 2010, the

Company recognized gains of $8,683 in selling, general and administrative expenses related to the trading of

derivative instruments. As of January 31, 2009, the Company had a series of Forward Currency Contracts

outstanding, with a gross notional value of $389,447 and a net notional value of $189,205. For the 52 weeks

F-18

GAMESTOP CORP.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)