GameStop 2009 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2009 GameStop annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Company to pay a premium in excess of 100% of the principal amount are defined in the Indenture. Upon a Change

of Control (as defined in the Indenture), the Issuers are required to offer to purchase all of the Notes then outstanding

at 101% of the principal amount thereof plus accrued and unpaid interest, if any, to the date of purchase. The Issuers

may acquire Senior Notes by means other than redemption, whether by tender offer, open market purchases,

negotiated transactions or otherwise, in accordance with applicable securities laws, so long as such acquisitions do

not otherwise violate the terms of the Indenture.

Between May 2006 and September 2009, the Company repurchased and redeemed the $300,000 of Senior

Floating Rate Notes and $200,000 of Senior Notes under previously announced buybacks authorized by the

Company’s Board of Directors. All of the authorized amounts were repurchased or redeemed and the repurchased

Notes were delivered to the Trustee for cancellation. The associated loss on the retirement of debt was $5,323,

$2,331 and $12,591 for the 52 week periods ended January 30, 2010, January 31, 2009 and February 2, 2008,

respectively, which consisted of the premium paid to retire the Notes and the write-off of the deferred financing fees

and the original issue discount on the Notes.

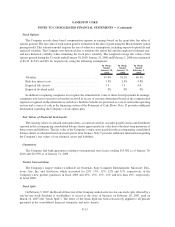

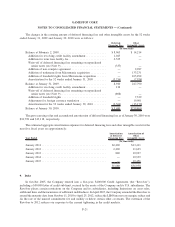

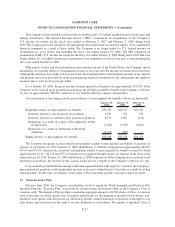

The changes in the carrying amount of the Senior Notes for the Company for the 52 weeks ended January 31,

2009 and the 52 weeks ended January 30, 2010 were as follows, in thousands:

Balance at February 2, 2008 .............................................. $574,473

Repurchase of Senior Notes, net ........................................... (28,761)

Balance at January 31, 2009 .............................................. $545,712

Repurchase of Senior Notes, net ........................................... (98,369)

Balance at January 30, 2010 .............................................. $447,343

In November 2008, in connection with the acquisition of Micromania, the Company entered into a Term Loan

Agreement (the “Term Loan Agreement”) with Bank of America, N.A. and Banc of America Securities LLC. The

Term Loan Agreement provided for term loans (“Term Loans”) in the aggregate of $150,000, consisting of a

$50,000 secured term loan (“Term Loan A”) and a $100,000 unsecured term loan (“Term Loan B”). The effective

interest rate on Term Loan A was 5.75% per annum and the effective rate on Term Loan B ranged from 5.0% to

5.75% per annum.

In addition to the $150,000 under the Term Loans, the Company borrowed $275,000 under the Revolver to

complete the acquisition of Micromania in November 2008. As of January 31, 2009, the Revolver and the Term

Loans were repaid in full.

In October 2004, GameStop issued a promissory note in favor of Barnes & Noble, Inc. (“Barnes & Noble”) in

the principal amount of $74,020 in connection with the repurchase of the Company’s common stock held by

Barnes & Noble. The note was unsecured and bore interest at 5.5% per annum, payable with each principal

installment. The final scheduled principal payment of $12,173 was made in October 2007, satisfying the promissory

note in full.

As of January 31, 2009 and January 30, 2010, the only long-term debt outstanding was the Senior Notes.

The maturity on the $450,000 Senior Notes, gross of the unamortized original issue discount of $2,657, occurs

in the fiscal year ending January 2013.

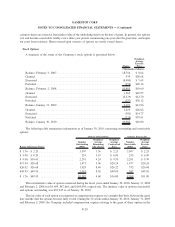

10. Leases

The Company leases retail stores, warehouse facilities, office space and equipment. These are generally leased

under noncancelable agreements that expire at various dates through 2034 with various renewal options for

additional periods. The agreements, which have been classified as operating leases, generally provide for minimum

and, in some cases, percentage rentals and require the Company to pay all insurance, taxes and other maintenance

F-23

GAMESTOP CORP.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)