GameStop 2009 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2009 GameStop annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

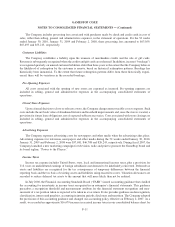

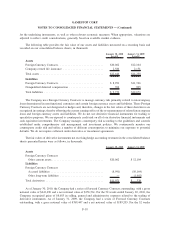

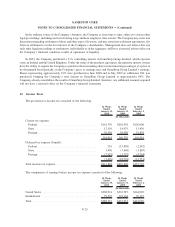

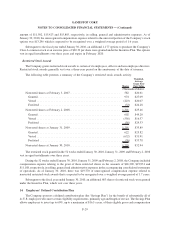

The changes in the carrying amount of deferred financing fees and other intangible assets for the 52 weeks

ended January 31, 2009 and January 30, 2010 were as follows:

Deferred

Financing Fees

Other

Intangible Assets

(In thousands)

Balance at February 2, 2008 .............................. $8,963 $ 14,214

Addition for revolving credit facility amendment ............. 1,025 —

Addition for term loan facility fee ........................ 2,525 —

Write-off of deferred financing fees remaining on repurchased

senior notes (see Note 9) . . . .......................... (337) —

Addition of non-compete agreement ...................... — 2,987

Addition of tradename from Micromania acquisition .......... — 133,231

Addition of leasehold rights from Micromania acquisition ...... — 105,292

Amortization for the 52 weeks ended January 31, 2009 ........ (3,256) (7,934)

Balance at January 31, 2009 .............................. 8,920 247,790

Addition for revolving credit facility amendment ............. 134 —

Write-off of deferred financing fees remaining on repurchased

senior notes (see Note 9) . . . .......................... (808) —

Addition of leasehold rights . . .......................... — 7,339

Adjustment for foreign currency translation ................. — 19,901

Amortization for the 52 weeks ended January 30, 2010 ........ (2,566) (15,170)

Balance at January 30, 2010 .............................. $5,680 $259,860

The gross carrying value and accumulated amortization of deferred financing fees as of January 30, 2010 were

$18,798 and $13,118, respectively.

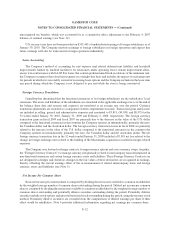

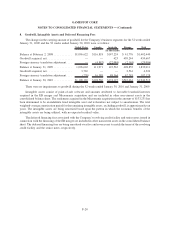

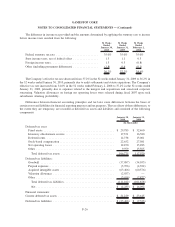

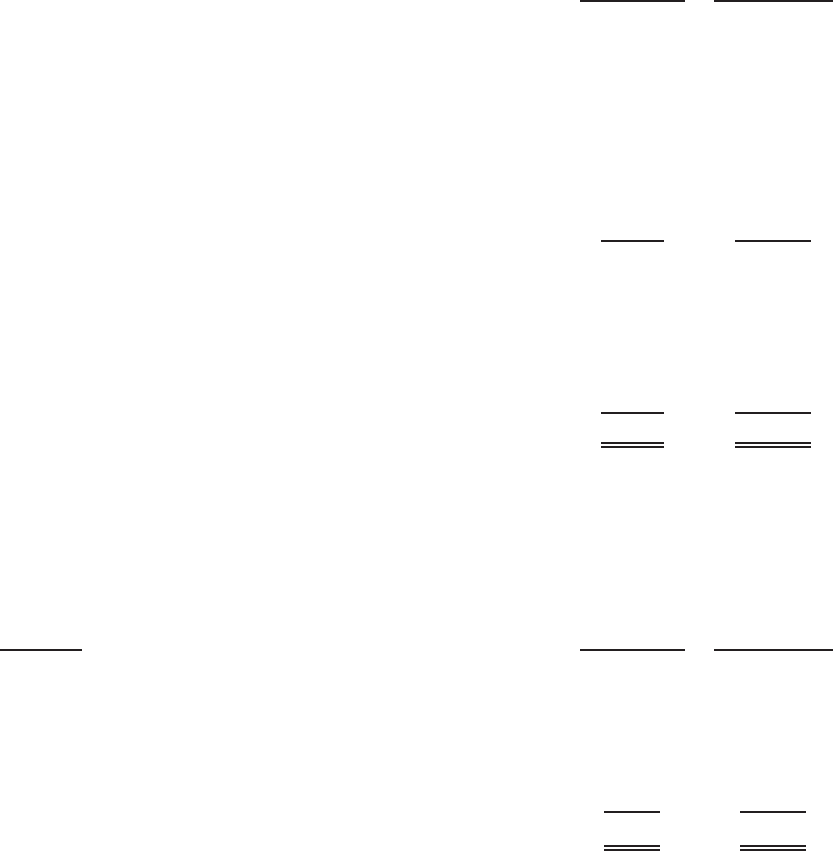

The estimated aggregate amortization expenses for deferred financing fees and other intangible assets for the

next five fiscal years are approximately:

Year Ended

Amortization

of Deferred

Financing Fees

Amortization of

Other

Intangible Assets

(In thousands)

January 2011 ......................................... $2,420 $13,411

January 2012 ......................................... 2,420 11,625

January 2013 ......................................... 840 10,927

January 2014 ......................................... — 10,539

January 2015 ......................................... — 10,456

$5,680 $56,958

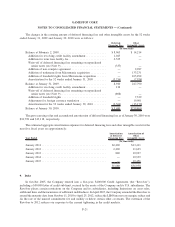

9. Debt

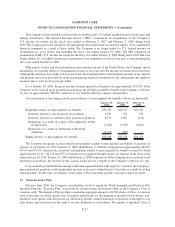

In October 2005, the Company entered into a five-year, $400,000 Credit Agreement (the “Revolver”),

including a $50,000 letter of credit sub-limit, secured by the assets of the Company and its U.S. subsidiaries. The

Revolver places certain restrictions on the Company and its subsidiaries, including limitations on asset sales,

additional liens and the incurrence of additional indebtedness. In April 2007, the Company amended the Revolver to

extend the maturity date from October 11, 2010 to April 25, 2012, reduce the LIBO interest rate margin, reduce and

fix the rate of the unused commitment fee and modify or delete certain other covenants. The extension of the

Revolver to 2012 reduces our exposure to the current tightening in the credit markets.

F-21

GAMESTOP CORP.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)