GameStop 2009 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2009 GameStop annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Item 3. Legal Proceedings

On February 14, 2005, and as amended, Steve Strickland, as personal representative of the Estate of

Arnold Strickland, deceased, Henry Mealer, as personal representative of the Estate of Ace Mealer, deceased,

and Willie Crump, as personal representative of the Estate of James Crump, deceased, filed a wrongful death lawsuit

against GameStop, Sony, Take-Two Interactive, Rock Star Games and Wal-Mart (collectively, the “Defendants”)

and Devin Moore, alleging that Defendants’ actions in designing, manufacturing, marketing and supplying

Defendant Moore with violent video games were negligent and contributed to Defendant Moore killing Arnold

Strickland, Ace Mealer and James Crump. Moore was found guilty of capital murder in a criminal trial and was

sentenced to death in August 2005.

Plaintiffs’ counsel named an expert who plaintiffs indicated would testify that violent video games were a

substantial factor in causing the murders. The testimony of plaintiffs’ psychologist expert was heard by the Court on

October 30, 2008, and the motion to exclude that testimony was argued on December 12, 2008. On July 30, 2009,

the trial court entered its Order granting summary judgment for all defendants, dismissing the case with prejudice on

the grounds that plaintiffs’ expert’s testimony did not satisfy the Frye standard for expert admissibility. Subsequent

to the entry of the Order, plaintiffs filed a notice of appeal. The Company does not believe there is sufficient

information to estimate the amount of the possible loss, if any, resulting from the lawsuit if the plaintiffs’ appeal is

successful.

In the ordinary course of the Company’s business, the Company is, from time to time, subject to various other

legal proceedings, including matters involving wage and hour employee class actions. The Company may enter into

discussions regarding settlement of these and other types of lawsuits, and may enter into settlement agreements, if it

believes settlement is in the best interest of the Company’s shareholders. Management does not believe that any

such other legal proceedings or settlements, individually or in the aggregate, will have a material adverse effect on

the Company’s financial condition, results of operations or liquidity.

Item 4. Reserved

PART II

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of

Equity Securities

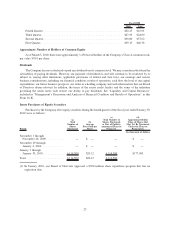

Price Range of Common Stock

The Company’s Class A common stock is traded on the NYSE under the symbol “GME.” The Company’s

Class B common stock was traded on the NYSE under the symbol “GME.B” until February 7, 2007 when,

immediately following approval by a majority of the Class B common stockholders in a Special Meeting of the

Company’s Class B common stockholders, all outstanding Class B common shares were converted into Class A

common shares on a one-for-one basis.

The following table sets forth, for the periods indicated, the high and low sales prices (as adjusted for the Stock

Split) of the Class A common stock on the NYSE Composite Tape:

High Low

Fiscal 2009

Fourth Quarter .................................................. $26.05 $19.42

Third Quarter ................................................... $28.62 $22.04

Second Quarter.................................................. $30.29 $20.02

First Quarter.................................................... $32.82 $21.81

22