GameStop 2009 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2009 GameStop annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.video game retailer in the U.S. and 12 other countries, by merging its existing operations with EB under GameStop

Corp. (the “EB merger”).

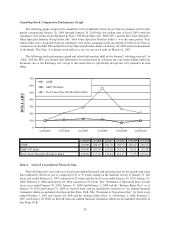

On February 9, 2007, the Board of Directors of the Company authorized a two-for-one stock split, effected by a

one-for-one stock dividend to stockholders of record at the close of business on February 20, 2007, paid on

March 16, 2007 (the “Stock Split”). Unless otherwise indicated, all numbers in this “Management’s Discussion and

Analysis of Financial Condition and Results of Operations” have been restated to reflect the Stock Split.

On November 17, 2008, GameStop France SAS, a wholly-owned subsidiary of the Company, completed the

acquisition of substantially all of the outstanding capital stock of SFMI Micromania SAS (“Micromania”) for

$580.4 million, net of cash acquired in the transaction. Micromania is the leading retailer of video and computer

games in France with 368 locations, 328 of which were operating on the date of acquisition (the “Micromania

acquisition”). The Company’s operating results for fiscal 2009 include Micromania’s results and the Company’s

operating results for fiscal 2008 include 11 weeks of Micromania’s results.

The acquisition of Micromania is an important part of the Company’s European and overall growth strategy

and gave the Company an immediate entrance into the second largest video game market in Europe. The amount the

Company paid in excess of the fair value of the net assets acquired was primarily for (i) the expected future cash

flows derived from the existing business and its infrastructure, (ii) the geographical benefits from adding stores in a

new large, growing market without cannibalizing existing sales, (iii) expanding the Company’s expertise in the

European video game market as a whole, and (iv) increasing the Company’s impact on the European market,

including increasing its purchasing power.

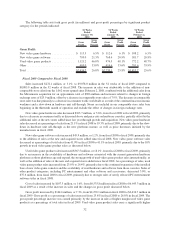

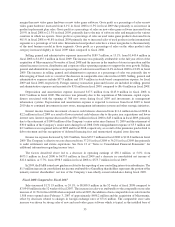

Growth in the video game industry is driven by the introduction of new technology. The current generation of

hardware consoles (the Sony PlayStation 3, the Microsoft Xbox 360 and the Nintendo Wii) were introduced

between 2005 and 2007. The Sony PlayStation Portable (the “PSP”) was introduced in 2005. The Nintendo DSi was

introduced in early 2009. Typically, following the introduction of new video game platforms, sales of new video

game hardware increase as a percentage of total sales in the first full year following introduction. As video game

platforms mature, the sales mix attributable to complementary video game software and accessories, which

generate higher gross margins, generally increases in the subsequent years. The net effect is generally a decline in

gross margins in the first full year following new platform releases and an increase in gross margins in the years

subsequent to the first full year following the launch period. Unit sales of maturing video game platforms are

typically also driven by manufacturer-funded retail price reductions, further driving sales of related software and

accessories. We expect that the installed base of the hardware platforms listed above and sales of related software

and accessories will increase in the future.

Critical Accounting Policies

The Company believes that the following are its most significant accounting policies which are important in

determining the reporting of transactions and events:

Use of Estimates. The preparation of financial statements in conformity with accounting principles

generally accepted in the United States of America (“GAAP”) requires management to make estimates and

assumptions that affect the reported amounts of assets and liabilities, the disclosure of contingent assets and

liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the

reporting period. In preparing these financial statements, management has made its best estimates and

judgments of certain amounts included in the financial statements, giving due consideration to materiality.

Changes in the estimates and assumptions used by management could have significant impact on the

Company’s financial results. Actual results could differ from those estimates.

Revenue Recognition. Revenue from the sales of the Company’s products is recognized at the time of

sale and is stated net of sales discounts. The sales of used video game products are recorded at the retail price

charged to the customer. Sales returns (which are not significant) are recognized at the time returns are made.

Subscription and advertising revenues are recorded upon release of magazines for sale to consumers.

Magazine subscription revenue is recognized on a straight-line basis over the subscription period. Revenue

27