GameStop 2009 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2009 GameStop annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

was unsecured and bore interest at 5.5% per annum, payable with each principal installment. The final scheduled

principal payment of $12.2 million was made in October 2007, satisfying the promissory note in full.

We used cash to expand the Company through acquisitions during fiscal 2008. On April 5, 2008, the Company

purchased all the outstanding stock of FRS for $21.0 million, net of cash acquired. FRS operated 49 record stores in

Norway and also operated office and warehouse facilities in Oslo, Norway. The Company converted these stores

into video game stores with an inventory assortment similar to its other stores in Norway.

In 2003, the Company purchased a 51% controlling interest in GameStop Group Limited which operates stores

in Ireland and the United Kingdom. Under the terms of the purchase agreement, the minority interest owners of the

remaining 49% have the ability to require the Company to purchase their remaining shares in incremental

percentages at a price to be determined based partially on the Company’s price to earnings ratio and GameStop

Group Limited’s earnings. In June 2008, the minority interest owners exercised their right to sell one-third of their

shares, or approximately 16% of GameStop Group Limited, to the Company under the terms of the original

purchase agreement for $27.4 million. In July 2009, an additional 16% was purchased for $4.7 million, bringing the

Company’s total interest in GameStop Group Limited to approximately 84%.

On November 17, 2008, GameStop France SAS, a wholly owned subsidiary of GameStop, completed the

acquisition of substantially all of the outstanding capital stock of SFMI Micromania from its shareholders for

approximately $580.4 million, net of cash acquired. Micromania is a leading retailer of video and computer games

in France with 368 stores as of January 30, 2010. The Company funded the transaction with cash on hand, a draw on

the Revolver totaling $275.0 million, and the Term Loans.

On November 4, 2009, the Company purchased a controlling interest in Omac Global Medial Limited, an

online video game developer and operator, as part of the Company’s overall digital growth strategy. The acquisition

in the amount of $3.8 million was accounted for using the acquisition method of accounting, with the excess of the

purchase price over the net assets acquired, in the amount of $3.8 million, recorded as goodwill.

On January 11, 2010, the Board of Directors of the Company approved a $300 million share repurchase

program authorizing the Company to repurchase its common stock. For fiscal 2009, the number of shares

repurchased were 6.1 million for an average price per share of $20.12. Approximately $64.6 million of treasury

share purchases were not settled at the end of fiscal 2009 and have been reported in accrued liabilities. Since the end

of fiscal 2009, the Company has purchased an additional 6.5 million shares for an average price per share of $19.03.

Based on our current operating plans, we believe that available cash balances, cash generated from our

operating activities and funds available under the Revolver will be sufficient to fund our operations, required

payments on the Senior Notes, store expansion and remodeling activities and corporate capital expenditure

programs for at least the next 12 months.

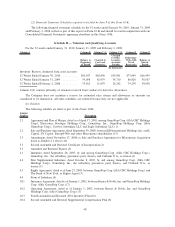

Contractual Obligations

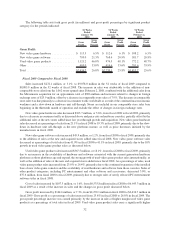

The following table sets forth our contractual obligations as of January 30, 2010:

Contractual Obligations Total

Less Than

1 Year 1-3 Years 3-5 Years

More Than

5 Years

Payments Due by Period

(In millions)

Long-Term Debt(1) ................ $ 558.0 $ 36.0 $ 522.0 $ — $ —

Operating Leases .................. 1,265.5 338.7 511.2 260.7 154.9

Purchase Obligations(2) ............. 849.5 849.5 — — —

Total ........................... $2,673.0 $1,224.2 $1,033.2 $260.7 $154.9

(1) The long-term debt consists of $450.0 million (principal value), which bears interest at 8.0% per annum.

Amounts include contractual interest payments.

(2) Purchase obligations represent outstanding purchase orders for merchandise from vendors. These purchase

orders are generally cancelable until shipment of the products.

42