GameStop 2008 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2008 GameStop annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Subsequent to the fiscal year ended January 31, 2009, an additional 1,419 options to purchase the Company’s

Class A common stock at an exercise price of $26.02 per share were granted under the Incentive Plan. The options

vest in equal installments over three years and expire in February 2019.

Restricted Stock Awards

The Company grants restricted stock awards to certain of its employees, officers and non-employee directors.

Restricted stock awards generally vest over a three-year period on the anniversary of the date of issuance.

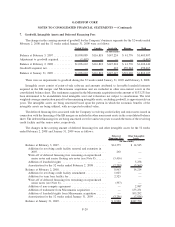

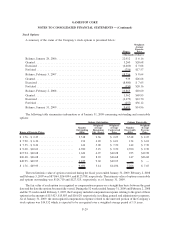

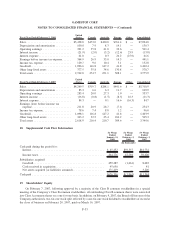

The following table presents a summary of the Company’s restricted stock awards activity:

Shares

Weighted-

Average

Grant Date

Fair Value

(Thousands of shares)

Nonvested shares at January 28, 2006 ................................ 100 $17.94

Granted .................................................... 532 $20.86

Vested ..................................................... (50) $17.94

Nonvested shares at February 3, 2007 ................................ 582 $20.61

Granted .................................................... 974 $27.09

Vested ..................................................... (223) $20.07

Forfeited ................................................... (32) $24.28

Nonvested shares at February 2, 2008 ................................ 1,301 $25.46

Granted .................................................... 602 $49.20

Vested ..................................................... (556) $16.57

Forfeited ................................................... (56) $29.53

Nonvested shares at January 31, 2009 ................................ 1,291 $35.89

The 532 shares of restricted stock granted in the 53 weeks ended February 3, 2007 vest in either equal

installments over three years or in total at the end of three years depending on the grant. The 602 and 974 shares of

restricted stock granted in the 52-week periods ended January 31, 2009 and February 2, 2008, respectively, vest in

equal installments over three years.

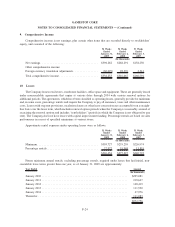

During the 52 weeks ended January 31, 2009, 52 weeks ended February 2, 2008 and the 53 weeks ended

February 3, 2007, the Company included compensation expense relating to the grant of these restricted shares in the

amounts of $19,931, $11,108 and $4,349, respectively, in selling, general and administrative expenses in the

accompanying consolidated statements of operations. As of January 31, 2009, there was $23,436 of unrecognized

compensation expense related to nonvested restricted stock awards that is expected to be recognized over a

weighted average period of 1.8 years.

Subsequent to the fiscal year ended January 31, 2009, an additional 571 shares of restricted stock were granted

under the Incentive Plan, which vest over three years.

14. Employees’ Defined Contribution Plan

The Company sponsors a defined contribution plan (the “Savings Plan”) for the benefit of substantially all of

its U.S. employees who meet certain eligibility requirements, primarily age and length of service. The Savings Plan

allows employees to invest up to 60%, up to a maximum of $15.5 a year, of their eligible gross cash compensation

invested on a pre-tax basis. The Company’s optional contributions to the Savings Plan are generally in amounts

based upon a certain percentage of the employees’ contributions. The Company’s contributions to the Savings Plan

F-30

GAMESTOP CORP.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)