GameStop 2008 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2008 GameStop annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.excluding goodwill and the Micromania tradename, is approximately ten years. The intangible assets are being

amortized based upon the pattern in which the economic benefits of the intangible assets are being utilized, with no

expected residual value. None of the goodwill is deductible for income tax purposes. Note 7 provides additional

information concerning goodwill and intangible assets.

Merger-related expenses totaling $4,593 shown in the fiscal 2008 statements of operations include a net loss

related to the change in foreign exchange rates related to the funding of the Micromania acquisition and other costs

considered to be of a one-time or short-term nature which are included in operating earnings.

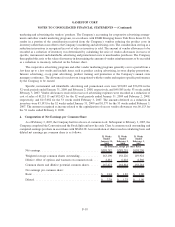

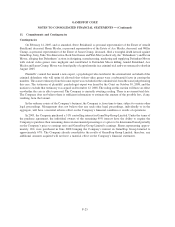

On April 5, 2008, the Company purchased all the outstanding stock of Free Record Shop Norway AS, a

Norwegian private limited liability company (“FRS”), for $21,006, net of cash acquired. FRS operated 49 record

stores in Norway, nine of which have been closed as of January 31, 2009. The Company has converted the remaining

stores into video game stores with an inventory assortment similar to its other stores in Norway. The acquisition was

accounted for using the purchase method of accounting, with the excess of the purchase price over the net assets

acquired, in the amount of $17,981, recorded as goodwill. The Company has included the results of operations of

FRS, which were not material, in its financial statements beginning on the closing date of the acquisition on April 5,

2008.

In 2003, the Company purchased a 51% controlling interest in GameStop Group Limited which operates stores

in Ireland and the United Kingdom. Under the terms of the purchase agreement, the minority interest owners of the

remaining 49% have the ability to require the Company to purchase their remaining shares in incremental

percentages at a price to be determined based partially on the Company’s price to earnings ratio and GameStop

Group Limited’s earnings. On May 21, 2008, the minority interest owners exercised their right to sell one-third of

their shares, or approximately 16% of GameStop Group Limited, to the Company under the terms of the original

purchase agreement for $27,383. The transaction was completed in June 2008 and recorded in accordance with the

provisions of SFAS 141.

During July 2008, the Company purchased certain assets and website operations from The Gamesman

Limited, a video game and entertainment software retailer, including eight stores in New Zealand, for $1,910. The

acquisition was accounted for using the purchase method of accounting, with the excess of the purchase price over

the net assets acquired, in the amount of $605, recorded as goodwill. The Company has included the results of

operations of the eight New Zealand stores acquired from The Gamesman Limited, which were not material, in the

Company’s financial statements beginning on the closing date of the acquisition on July 14, 2008.

On January 13, 2007, the Company purchased Game Brands Inc. (“Game Brands”), a 72-store video game

retailer operating under the name Rhino Video Games, for $11,344. The acquisition was accounted for using the

purchase method of accounting and, accordingly, the results of operations for the period subsequent to the

acquisition are included in the consolidated financial statements. The excess of the purchase price over the net assets

acquired, in the amount of $8,083 was recorded as goodwill in fiscal 2006. Purchase price adjustments to reduce

goodwill for Game Brands were $1,467 during fiscal 2007.

The pro forma effect assuming the above acquisitions were made at the beginning of fiscal 2006 is not material

to the Company’s consolidated financial statements.

Merger-related expenses of $6,788 shown in the statement of operations for fiscal 2006 include costs believed

to be of a one-time or short-term nature associated with integrating the operations of GameStop and EB during the

53 weeks ended February 3, 2007. The Company completed all integration activities relating to the EB merger in

fiscal 2006.

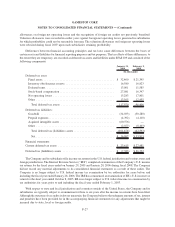

3. Vendor Arrangements

The Company and approximately 50 of its vendors participate in cooperative advertising programs and other

vendor marketing programs in which the vendors provide the Company with cash consideration in exchange for

F-17

GAMESTOP CORP.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)