GameStop 2008 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2008 GameStop annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

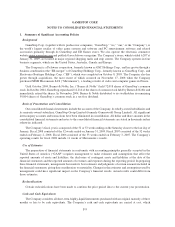

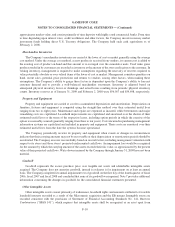

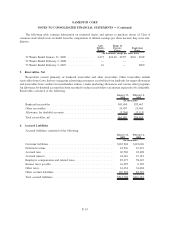

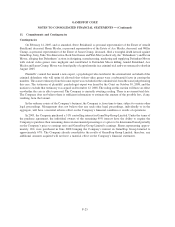

requirements to enable the evaluation of the nature and financial effects of the business combination. SFAS 141(R)

is effective for the Company on February 1, 2009, and the Company will apply prospectively SFAS 141(R) to all

business combinations subsequent to the effective date.

In December 2007, the FASB issued Statement of Financial Accounting Standards No. 160, Noncontrolling

Interests in Consolidated Financial Statements — an amendment of Accounting Research Bulletin No. 51

(“SFAS 160”). SFAS 160 establishes accounting and reporting standards for the noncontrolling interest in a

subsidiary and for the deconsolidation of a subsidiary. SFAS 160 also establishes disclosure requirements that

clearly identify and distinguish between the controlling and noncontrolling interests and requires the separate

disclosure of income attributable to controlling and noncontrolling interests. SFAS 160 became effective for the

Company on February 1, 2009. The Company is currently evaluating the impact that the adoption of SFAS 160 will

have on its consolidated financial statements.

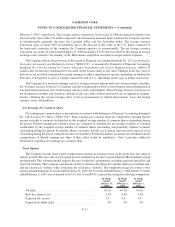

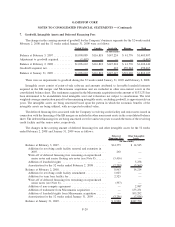

2. Acquisitions

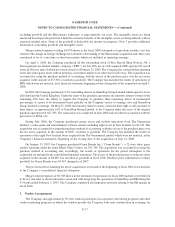

On November 17, 2008, GameStop France SAS, a wholly-owned subsidiary of the Company, completed the

acquisition of substantially all of the outstanding capital stock of Micromania for $580,407, net of cash acquired.

Micromania is a leading retailer of video and computer games in France with 332 locations, 328 of which were

operating upon acquisition. The Company funded the transaction with cash on hand, funds drawn against its

existing $400,000 credit agreement (the “Revolver”) totaling $275,000, and term loans totaling $150,000 under a

junior term loan facility (the “Term Loans”). As of January 31, 2009, all of the borrowings against the Revolver and

the Term Loans have been repaid. The purpose of the acquisition was to expand the Company’s presence in Europe.

The impact of the acquisition on the Company’s results of operations, as if the acquisition had been completed as of

the beginning of the periods presented, is not significant.

The consolidated financial statements include the results of Micromania from the date of acquisition and are

reported in the European segment. The purchase price has been allocated based on estimated fair values as of the

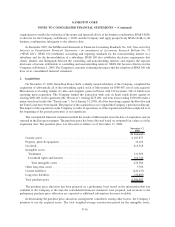

acquisition date. The purchase price was allocated as follows as of November 17, 2008:

November 17,

2008

(In thousands)

Current assets ...................................................... $187,877

Property, plant & equipment ............................................ 34,164

Goodwill .......................................................... 413,318

Intangible assets:

Tradename ....................................................... 131,560

Leasehold rights and interests . ........................................ 102,746

Total intangible assets ............................................. 234,306

Other long-term assets ................................................ 7,786

Current liabilities .................................................... (220,237)

Long-term liabilities ................................................. (76,807)

Total purchase price .................................................. $580,407

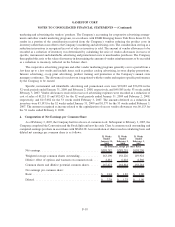

The purchase price allocation has been prepared on a preliminary basis based on the information that was

available to the Company at the time the consolidated financial statements were prepared, and revisions to the

preliminary purchase price allocation are expected as additional information becomes available.

In determining the purchase price allocation, management considered, among other factors, the Company’s

intention to use the acquired assets. The total weighted-average amortization period for the intangible assets,

F-16

GAMESTOP CORP.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)