GameStop 2008 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2008 GameStop annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

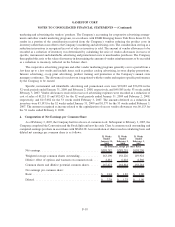

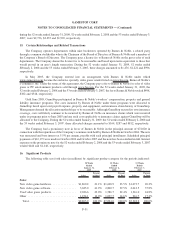

The Company adopted the provisions of FASB Interpretation No. 48, Accounting for Uncertainty in Income

Taxes (“FIN 48”), on February 4, 2007. As a result of the implementation of FIN 48, the Company recognized a

$16,679 increase in the liability for unrecognized tax benefits, interest and penalties, which was accounted for as a

reduction of the February 3, 2007 balance of retained earnings. As of February 4, 2007, the gross amounts of

unrecognized tax benefits, interest and penalties was $25,250. Additionally, adoption of FIN 48 resulted in the

reclassification of certain accruals for uncertain tax positions in the amount of $7,864 from prepaid taxes to other

long-term liabilities in our consolidated balance sheet.

For the 52 weeks ended January 31, 2009, the Company recognized an increase of $5,733 in the liability for

unrecognized tax benefits and an increase of $2,276 for interest and penalties. As of January 31, 2009, the gross

amount of unrecognized tax benefits, interest and penalties was $32,234. The total amount of unrecognized tax

benefit that, if recognized, would affect the effective tax rate was $26,578 for the fiscal year ended January 31, 2009.

For the 52 weeks ended February 2, 2008, the Company recognized a decrease of $1,597 in the liability for

unrecognized tax benefits and an increase of $572 for interest and penalties. As of February 2, 2008, the gross

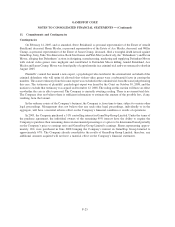

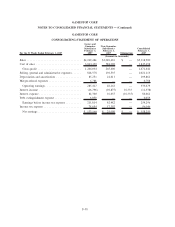

amount of unrecognized tax benefits, interest and penalties was $24,225. A reconciliation of the changes in the

gross balances of unrecognized tax benefits during the 52 weeks ended January 31, 2009 and the 52 weeks ended

February 2, 2008 follows:

January 31,

2009

February 2,

2008

(In thousands)

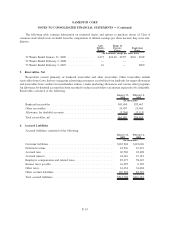

Beginning balance of unrecognized tax benefits ..................... $24,225 $25,250

Increases related to current period tax positions ................... 974 132

Increases (decreases) related to prior period tax positions ............ 8,667 (116)

Reductions as a result of a lapse of the applicable statute of

limitations ............................................. (1,072) (1,041)

Reductions as a result of settlements with taxing authorities .......... (560) —

Ending balance of unrecognized tax benefits ....................... $32,234 $24,225

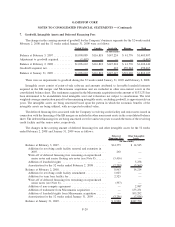

Prior to the adoption of FIN 48, the Company recognized interest relating to income tax matters as a

component of interest expense and recognized penalties relating to income tax matters as a component of selling,

general and administrative expense. Such interest and penalties were immaterial. Subsequent to adoption of FIN 48,

the Company recognizes accrued interest and penalties related to income tax matters in income tax expense. The

Company had $3,101 in interest and penalties related to unrecognized tax benefits accrued at the date of adoption

and $5,656 as of January 31, 2009.

It is reasonably possible that the amount of the unrecognized benefit with respect to certain of the Company’s

unrecognized tax positions could significantly increase or decrease within the next 12 months as a result of settling

ongoing audits. At this time, an estimate of the range of the reasonably possible outcomes cannot be made.

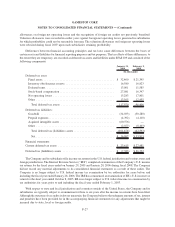

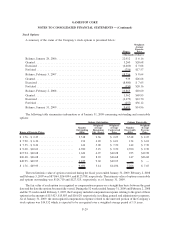

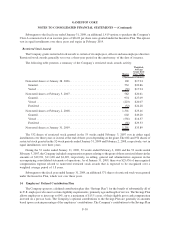

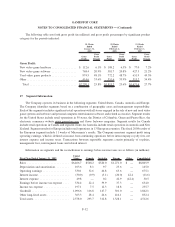

13. Stock Incentive Plan

Effective June 2007, the Company’s stockholders voted to amend the Amended and Restated 2001 Incentive

Plan (the “Incentive Plan”) to provide for issuance under the Incentive Plan of the Company’s Class A common

stock. The Incentive Plan provides a maximum aggregate amount of 43,500 shares of Class A common stock with

respect to which options may be granted and provides for the granting of incentive stock options, non-qualified

stock options, and restricted stock, which may include, without limitation, restrictions on the right to vote such

shares and restrictions on the right to receive dividends on such shares. The options to purchase Class A common

shares are issued at fair market value of the underlying shares on the date of grant. In general, the options vest and

become exercisable ratably over a three-year period, commencing one year after the grant date, and expire ten years

from issuance. Shares issued upon exercise of options are newly issued shares.

F-28

GAMESTOP CORP.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)